LIQUIDITY

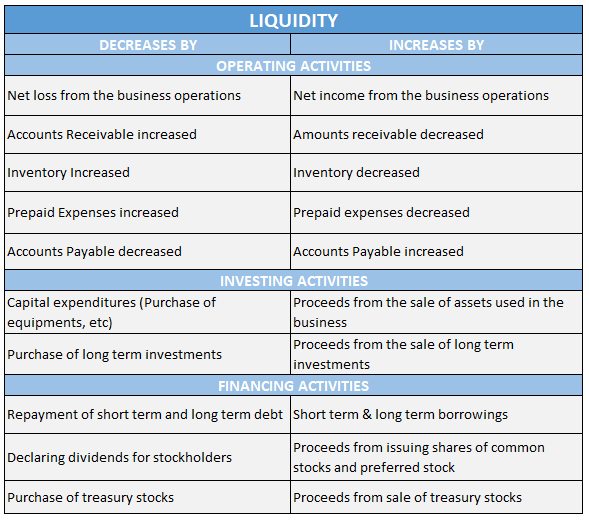

Liquidity is having cash & equivalents on-hand to pay company’s obligations when they are due. It can also be understood as the company’s ability to convert its current assets to cash for the payment of current liabilities. Liquidity is necessary for the company to continue its business operations.

WORKING CAPITAL V/S LIQUIDITY

Working capital & Liquidity are two close concepts and often these terms are used interchangeably. But they do not necessarily mean the same thing. Some businesses like that of retailer, distributor or manufacturer may report large amounts of working capital. However, still may fail to maintain required liquidity to pay their current obligations simply because of their slow moving inventory. Similarly, if the company is unable to collect its accounts receivables on time, it may struggle to maintain liquidity to pay its obligations upon agreed due dates.

On the other hand, an e-commerce company that sells fast moving products online to customers with instant payment option and with 60 days’ supplier credit period may report very little working capital, but certainly will have enough liquidity to meet its obligations.

Table of Contents : Accounting Principles

Accounting Principles & guidelines