BANK'S DEBIT & CREDIT

Bank’s debit & credit communications often confuse newbie in the field of accounting. When you make a purchase using your debit/ credit card, banks often communicate with you stating, “Your account is debited by xxx amount against the purchase…” and when you receive salary/money from someone, bank communicates stating, “Your account is credited with xyz amount…”. This may seem puzzling and contrary to what we learnt earlier i.e. when money is received, your cash account gets debited and when you pay cash to make a purchase, your cash account gets credited.

The reason for this kind of seemingly contradictory communication is that bank sends these communications in its own context and not in customer’s context. These communications are indeed consistent with the basic accounting principles we learnt earlier. To understand the concept, let’s look at the below transactions and the related journal entries from both the bank’s perspective and the company’s perspective –

Example. Let’s say a company; Supreme Car rentals received $500 from a customer in exchange of services provided to it. The money was received directly in company’s bank account via wire transfer.

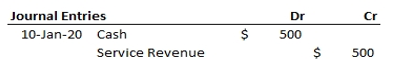

For Supreme Car rentals, $500 was received as service revenue affecting its cash account. Thus, below journal entries would be captured in the books of the company –

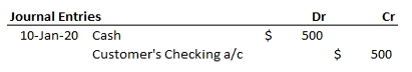

For the bank, $500 was received as a result of this transaction. Hence, bank’s cash account balance will increase. Since the bank has not earned his $500; it cannot credit a revenue account. Instead, the bank credits a liability account such as Customer’s Checking account to reflect bank’s obligation/ liability to return $500 to the Supreme Care rental company on demand. Thus, below journal entries would be captured in the books of the bank for the same transaction –

Therefore, the communications that we receive as an individual/ company from banks indeed reflects the changes in Customer’s checking a/c in context of bank themselves. These are perfectly in line with the accounting principles discussed earlier and must not be confused with the transactional entries made in context of a company or an individual.

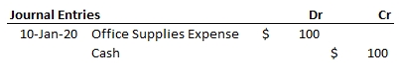

On similar lines if “Supreme Car rentals” spends $100 on the purchase of office supplies, following journal entries would be recorded in the books of the company –

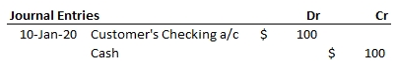

And Bank would capture below journal entries in its book –

As a bank’s customer, you would receive a message stating, “Your account is debit by $100 against the purchase made … “, which would simply reflect behavior of Customer’s Checking a/c in the context of the bank.

Table of Contents : Accounting Principles

Accounting Principles & guidelines