DEBITS & CREDITS

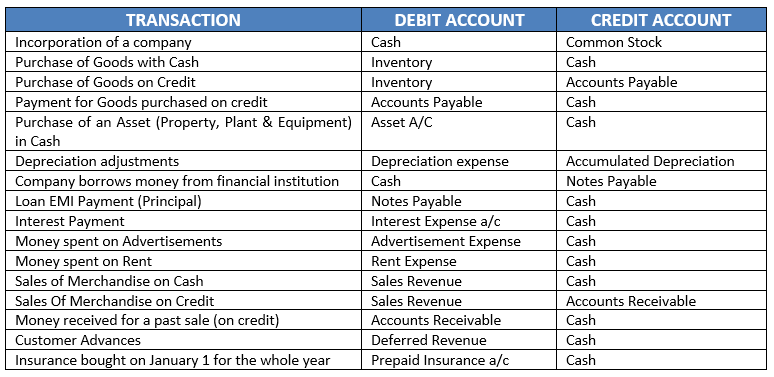

Once you have identified the two or more accounts involved in the business transaction, you must debit at least one and credit at least one account for recording the transaction in your books. Identifying the accounts for debit & credit can be understood from the following discussion.

All accounts reported on the financial statements can be categorized into two categories –

Accounts with Debit balances (balances in these accounts are increased with a debit)

- Dividends

- Expenses

- Assets

- Losses

Accounts with Credit balances (balances in these accounts are increased with a credit)

- Gains

- Income

- Revenues

- Liabilities

- Stockholders’ (owner’s) Equity

To decrease an account, you do the opposite of what was done to increase the account. For instance, Cash, an asset account is increased with a debit (i.e. when cash is received) and decreased with a credit (i.e. when cash is paid out).

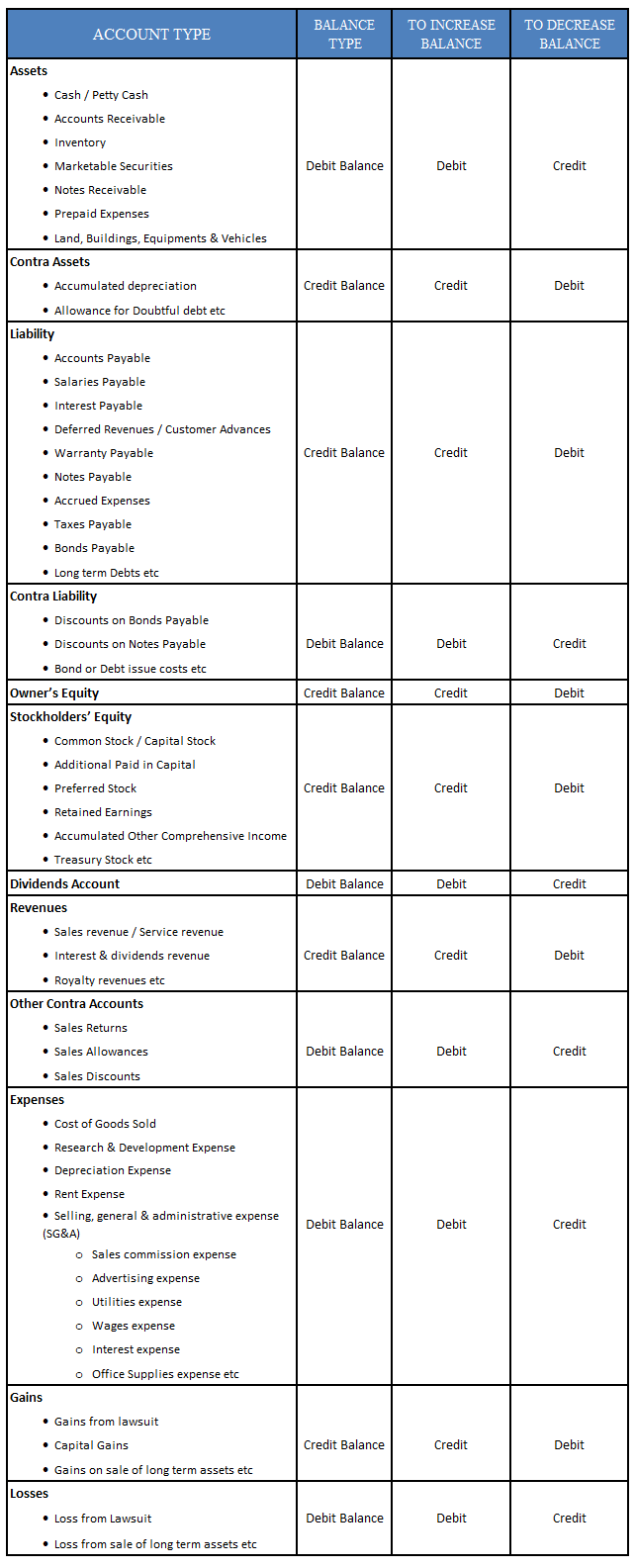

Following is the list of accounts with their balance type. You need not worry if you do not understand the meaning of these accounts. We have explained it all in detail in the later sections this site.

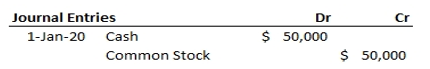

Example. John & Diana incorporated Krishna Corporation; a private company and invested $50,000 (@$1 par value per share) on January 01, 2020.

As a result of this transaction, balance in the cash account of the company will increase by $50,000, thus it will be debited (as cash is debit balance account & balances in these account types are increased with a debit). Also, new shares (common stock) will be issued to John & Diana in exchange of this investment, thus increasing the number of shares in the market. Since Common Stock is a credit balance account, this increase in shares will be marked with a credit.

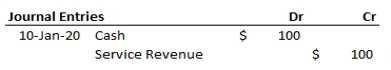

Example. Assume post incorporation, Krishna Corporation provided a professional service to a client and was paid $100 immediately in exchange for the service. This $100 will be treated as a Service Revenue for Krishna Corporation and will result in an increase in its cash reserves. Journal entry for the given transaction will be captured as below –

Table of Contents : Accounting Principles

Accounting Principles & guidelines