DOUBLE ENTRY SYSTEM OF ACCOUNTING

Double entry system of accounting ensures that every business transaction must be recorded in a minimum of two accounts. Though recording an entry in less than two accounts is not possible but there might be instances when particular business transactions are recorded using three or more business accounts. In such cases the total amount entered as debits must be equal to the total amount entered as credits. This system of accounting ensures that below accounting equation holds true for all the bookkeeping entries-

EXAMPLE

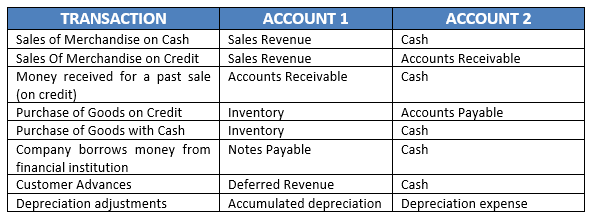

Below is the list of a few business transactions and the accounts that it is likely to impact under double entry system of accounting principle.

JOURNAL ENTRIES

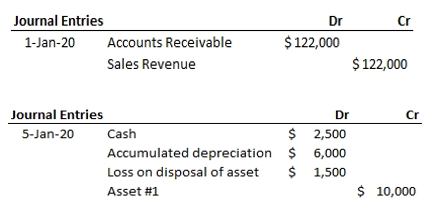

Accountants and bookkeepers often use visualization techniques to understand the effect of a business transaction on the accounts involved. Journal Entries is one such technique.

A typical journal entry looks like one below. It has a date, account names and debit & credit values. The accounts to be credited are indented.

A debit transaction is abbreviated as Dr and a credit transaction is abbreviated as Cr.

Table of Contents : Accounting Principles

Accounting Principles & guidelines