PREPARING FINANCIAL STATEMENTS: QUARTER 2 (Contd ... )

4. APRIL, 2020 TRANSACTIONS AND FINANCIAL STATEMENTS

April 01, 2020: Depreciation expense to be booked on all fixed assets owned by the company.

April 15, 2020: Company applied for $25,000 short term loan; Bank approves it at a fixed interest rate of 2% per month (on the loan amount) and company is required to pay it back uniformly over the next 5 months. Company receives this loan amount on April 30.

April 30, 2020: Company sold & delivered 50 bags during this month @ $150 per bag to a retailer; have raised $7,500 invoice, due for May 15.

JOURNAL ENTRIES

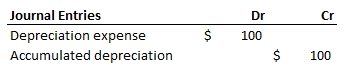

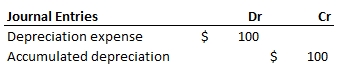

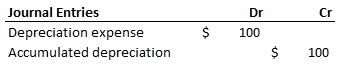

All the assets owned by the company must be depreciated and expensed off over their useful life. Therefore, following journal entry would be created every month for the office equipment asset that was purchased at the starting of the last month. Depreciation amount per month is calculated by dividing the cost of asset ($12,000 in our case) to its useful life (i.e. 10 years or 120 months)

In case the company owns more than one asset; all of them are required to be expensed off in a similar way every month.

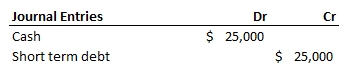

Company has also availed a short term loan in this period. This would increase its cash reserve and create a short term debt liability on the company. Journal entry for the transaction can be summarized as below –

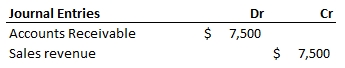

Company has made its first sale in the period by selling 50 bags but hasn’t received any payments for the same yet.

Under accrued accounting basis, the revenue must be reported in the accounting period in which it was earned (and not in which the cash was received). Therefore, even though no cash was received in April; still sales revenue would be reported in this period. Also, Un-received cash revenue will be recorded under Accounts receivable asset head on balance sheet. Journal entry for the transaction can be summarized as below –

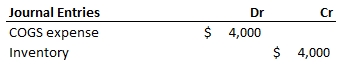

Matching principle states that inventory must be matched to revenue and expensed off in the period in which revenue is earned (and not in period in which these expenses were incurred). As sales of 50 bags (@ $150 per bag) has happened in April, therefore the corresponding inventory (50 bags @ $80 cost per bag) needs to be expensed off along with this revenue and in the same period. Cost of goods sold (COGS) account is used as inventory expense account on income statement. Therefore, another journal entry originating from the sales transaction would be as follows –

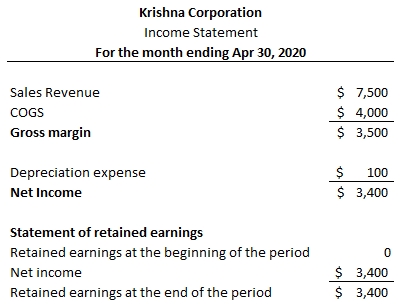

INCOME STATEMENT

Sales revenue, COGS & depreciation expense are the income statement accounts captured in above journal entries. These can be summarized on an income statement as below –

Note. The income statement shown above ends with a statement of retained earnings; it captures an important connection between the balance sheet and the income statement. “Retained earnings” from the previous period is added to net income to derive the “retained earnings” of the current period. This derived “retained earnings” needs to be reported on balance sheet. It is for this reason that we suggest to prepare income statement before balance sheet for any period.

BALANCE SHEET

Balance sheet accounts such as accumulated depreciation, cash, short term debt, accounts receivable & inventory are impacted by April transactions. The period’s end value balances for these accounts can be derived by considering the effect of journal entries over last period’s balances.

Net effect of these transactions on balance sheet can be summarized as below for April period –

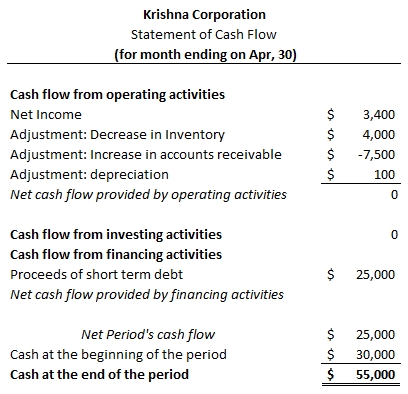

STATEMENT OF CASHFLOW

In this period; company has not invested or divested in any long term asset; therefore cash flow from investing activities would be reported as 0.

For deriving cash flow from operating activities, we start with capturing net income and adjust it in accordance with the changes in current assets and liabilities for the period. As discussed earlier, a decrease in inventory amount must be added; an increase in accounts receivable must be subtracted and depreciation expense must be added to the net income to adjust it in-line with cash accounting basis. Therefore, cash flow statement can be prepared as follows for this period –

5. MAY TRANSACTIONS AND FINANCIAL STATEMENTS

May 01, 2020: Depreciation expense to be booked on all fixed assets owned by the company.

May 10, 2020: Company received $7,500 for the bags sold last month.

May 30, 2020: Company spent $5,000 in promotions over advertising during the month; all paid in cash

May 31, 2020: Loan EMI payment; Interest payment ($5,000 against principal & 2% interest on total loan amount)

JOURNAL ENTRIES

Depreciation expense to be booked on office equipment, the only asset the company has as of now. Journal entry for the same would be as follows –

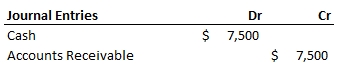

Company received $7,500 against the sale made in last period. This will increase the cash balance of the company and reduce the Accounts receivable balance as follows –

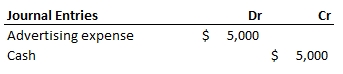

Company spent $5,000 in promotions over advertising. This will reduce the cash reserve for the company and would be booked as expense for the period.

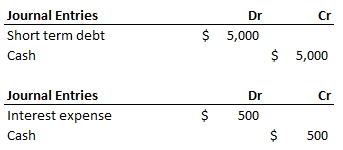

Company took a $25,000 short term debt last month. From this month onwards; it is required to pay back the principal amount ($5,000) and an interest of 2% or $500 on this loan amount. Journal entries for principal & interest payment would be as follows –

INCOME STATEMENT

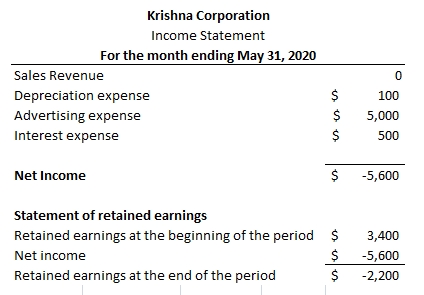

There have been no sales in the period. However company has incurred expenses on advertising, interest & depreciation. Therefore income statement for the period can be generated as –

Net income for the period would be added to retained earnings of the last period to derive retained earnings for this period. This derived “retained earnings” would be captured on balance sheet for the period.

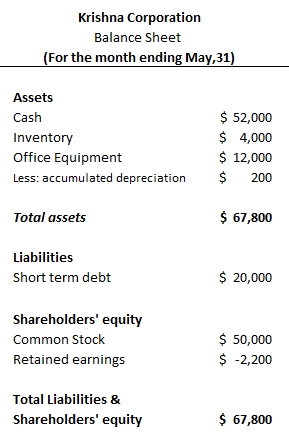

BALANCE SHEET

Balance sheet for the current period can be generated below by considering the previous period’s account balances and adjusting it as per the journal entries of this period.

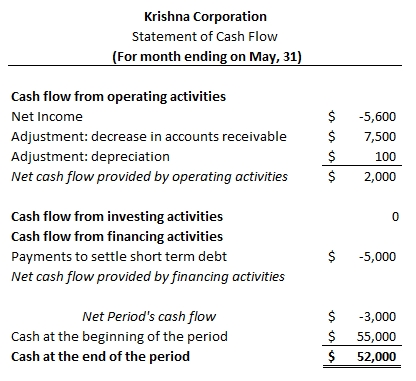

STATEMENT OF CASHFLOW

In this period; company has not invested or divested in any long term asset; therefore cash flow from investing activities would be reported as 0.

For deriving cash flow from operating activities, net income for the period is adjusted for decrease in accounts receivable & depreciation expense.

Principal payment for the period would be reported under cash flow from financing activities. Interest expense won’t be reported under this head as it is already included in net income calculation.

6. JUNE TRANSACTIONS AND FINANCIAL STATEMENTS

June 01, 2020: Depreciation expense to be booked on all fixed assets owned by the company.

June 15, 2020: Company decides that computer purchased earlier (office equipment) is no longer required. It sells it back in the market for $9,000

June 30, 2020: Loan EMI, Interest payment

JOURNAL ENTRIES

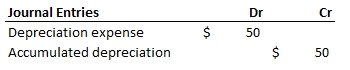

Before disposing an asset, we need to expense off all the accumulated depreciation on the asset till its date of disposal i.e. 15th June in our case. Following journal entries would be created in the process –

Depreciation of office equipment for the previous month can be captured as below –

Depreciation of office equipment for the current month & till the date of disposal (15 days) can be captured as below –

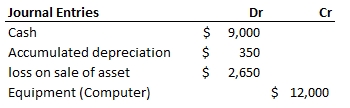

On 15th June, asset was sold in the market for $9,000. Journal entry for capturing this transaction can be captured as below –

Book value of equipment & accumulated depreciation till the date of its disposal would be reversed off at the time of its disposal. At the same time; company has earned $9,000 on its sale; thus increasing its cash reserves. The remaining deficit of $2,650 is booked under loss on sale of asset. In cases, where the money received on disposal of asset is greater than the net book value of the asset; a gain on sale of asset is booked. (Net book value of asset = book value of asset – accumulated depreciation)

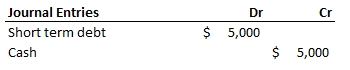

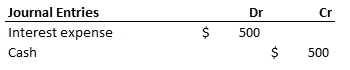

Principal and Interest payments for the short term debt can be booked as follows (same as we did for the last month) –

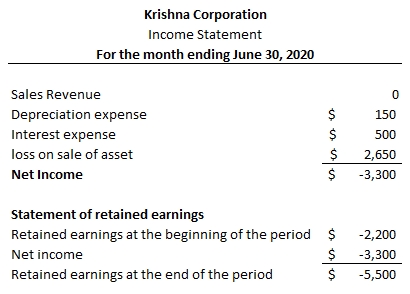

INCOME STATEMENT

Apart from reporting depreciation expense & Interest expense for the period; this month’s income statement will also report loss on sale of asset.

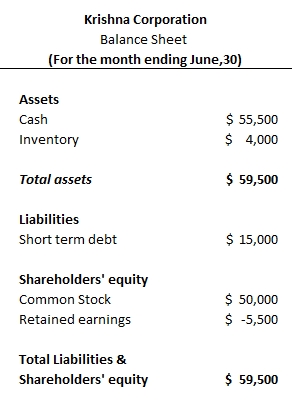

BALANCE SHEET

Using the journal entries above and the balances of the previous period’s balance sheet; this month’s balance sheet can be generated as follows –

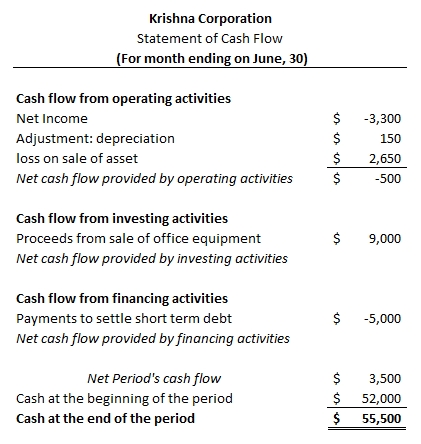

STATEMENT OF CASHFLOW

For deriving cash flow from operating activities, net income for the period is adjusted for depreciation expense and loss on sale of asset. Note both of these expenses were actually non-cash expenses that were considered while calculating net income under accrual accounting basis.

Cash flow from investing activities will report the sale of office equipment and the cash received for this sale.

Principal payment for the short term debt will reported under cash flow from financing activities.