PREPARING FINANCIAL STATEMENTS

In this section, we will attempt to prepare all three financial statements (Income statement, balance sheet & Statement of cash flow) from scratch using daily business transactions.

The sequence in which financial statements should be prepared is as below –

- Income Statement

- Balance Sheet

- Statement of Cash flow

Income statement must be prepared first because Net Income, an outcome of an income statement, is used for calculating retained earnings (a balance sheet item). So balance sheet has a dependency on income statement.

Similarly, Statement of cash flows is prepared at last as changes in various assets, liabilities, expenses etc as captured on balance sheet & income statement are required to derive various heads to be captured on cash-flow statement.

We have used a hypothetical company called Krishna Corporation for capturing several types of business transactions and have prepared monthly statements for the same.

1. JANUARY, 2020 TRANSACTIONS AND FINANCIAL STATEMENTS

January 01, 2020: John & Jim incorporated Krishna Corporation; a private company with an initial investment of $50,000 (@ $1 par value per share). It is registered as a trading company which deals in sale & purchase of ladies bags. This was the only transaction in January, 2020.

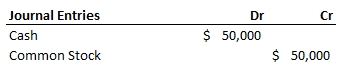

JOURNAL ENTRIES

Cash investment by John & Jim will increase cash account balance of the company (or bank deposits). In return, John & Jim would be allotted company shares worth $50,000 in form of common stocks.

Therefore, Journal entries prepared on January 31, 2020 would look like –

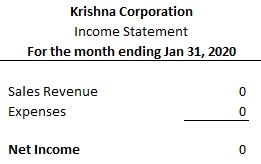

INCOME STATEMENT

The transaction happened in month of January have not resulted in any kind of sales or expense for the company. Therefore, for this period, both sales revenue and expenses would be captured as 0 on income statement.

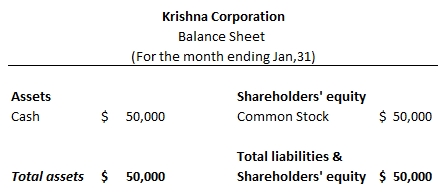

BALANCE SHEET

Accounts (Cash & Common Stock) impacted by January transaction are both balance sheet accounts and can be represented on balance sheet as below –

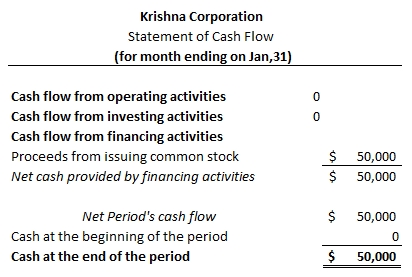

STATEMENT OF CASHFLOW

As company has not yet started its operations, Cash flow from operating activities would be recorded as 0. Similarly, cash flow from investing activities would also be recorded as 0; as company has not invested or divested any amount in purchase or sale of any long term asset.

However, Company does have borrowed money from its founders and issued common stocks; this activity would be captured under cash flow from financing activities. Apparently this is the only transaction resulting in cash flow for this period. Therefore, cash flow statement can be summarized as below –

Note. Derived value of “cash at the end of the period” on cashflow statement must match with cash reserves as captured on the balance sheet for the period.

2. FEBRUARY, 2020 TRANSACTIONS AND FINANCIAL STATEMENTS

February 02, 2020: Krishna Corporation purchases 100 units of designer bags from its supplier @ $80 per bag. Bags were delivered at Krishna Corporations’ warehouse on February 04, 2020 along with invoice due March 10, 2020. This is the only transaction in February.

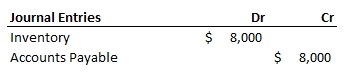

JOURNAL ENTRIES

Krishna Corporation is a trading company which deals in purchase & re-sale of ladies bags. In this period, they procured ladies bags (i.e. an inventory item) but haven’t made any payment for it to its suppliers. Therefore, Inventory account (due to purchase of merchandise) and Accounts payable account (creation of a liability due to non-payment) would be affected due to this transaction.

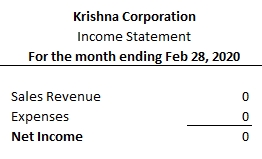

INCOME STATEMENT

Since above transaction does not result in any kind of sales or expense for the company. Therefore, both sales revenue and expenses would be captured as 0 for this period on income statement.

Now a layman could argue & and consider the purchase of inventory as an expense for the company in this period but it is not true. Matching principle requires expenses that have cause & effect linkage with revenues are to be matched with revenue and reported along them in the period in which the revenue is earned (and not in period where the expense was incurred). Since no revenue was earned against these items in the February, thus no expense can be booked against them in the period.

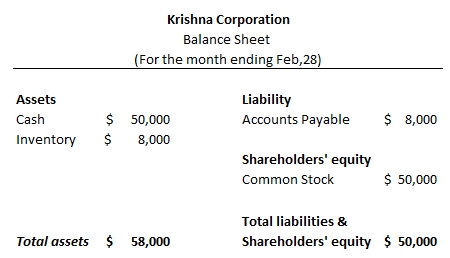

BALANCE SHEET

Accounts (Inventory & Accounts payable) impacted by February transaction are both balance sheet accounts and thus can be represented on balance sheet as below –

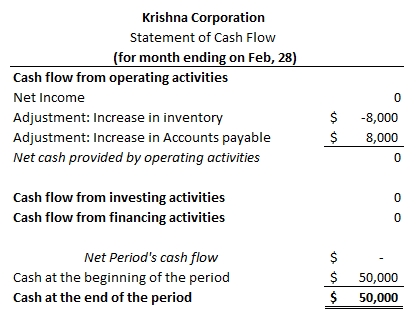

STATEMENT OF CASHFLOW

In this period; company has neither borrowed any cash nor has invested anything in long term assets; therefore, cash flow from investing activities & cash flow from financing activities would be captured as 0 on cash flow statement.

For deriving cash flow from operating activities, we start with capturing net income and adjust it in accordance with the changes in current assets and liabilities for the period. As discussed earlier, an increase in inventory amount must be subtracted and an increase in accounts payable must be added to the net income to adjust it in-line with cash accounting basis. Therefore, cash flow statement can be prepared as follows for this period –

3. MARCH, 2020 TRANSACTIONS AND FINANCIAL STATEMENTS

March 01, 2020: Krishna Corporation purchases office equipment (a computer) for record keeping at $12,000. It was paid in cash; installed & put to service immediately. It is expected to have a useful life of 10 years.

March 09, 2020: Company paid $8,000 to the supplier for the ladies bag it bought last month.

JOURNAL ENTRIES

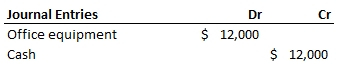

Office equipment (a computer) was purchased and paid in this period by the company. Since company’s primary activity is sale & purchase of ladies bags (and not computers); therefore this equipment can’t be considered as an inventory.

Useful life of the equipment is 10 years, which is way more than operating cycle period (of 1 year for most of the companies); therefore, this equipment purchase would be considered as an asset purchase and cost of its purchase would be expensed off over the life of the asset (and not entirely in period in which it was incurred).

Therefore following journal entries could be created for the March 01 transaction –

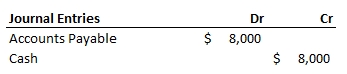

March 09 transaction is just the payment to supplier for the goods delivered by him in the last month. This will reduce the company liability (accounts payable) and the cash accounts.

Therefore following journal entries could be created for the March 09 transaction –

INCOME STATEMENT

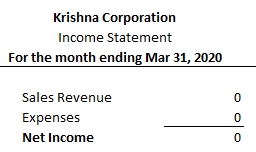

Since above transaction does not result in any kind of sales or expense for the company. Therefore, both sales revenue and expenses would be captured as 0 for this period on income statement.

A layman could argue & and confuse the purchase of the asset as an expense for the company in this period but it is not true. As we stated above, cost of an asset purchase would be expensed off over the life of the asset (and not entirely in period in which it was incurred). Therefore for this period no expense will be booked against this asset.

However, a depreciation of $100 ($12000/12*10) per month would be booked against this asset as an expense item on income statement from next month onwards. And this depreciation expense would continue to be reported each month on income statement until the useful life of asset is completed or the asset has been pre-maturely disposed.

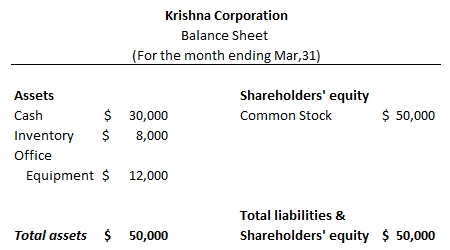

BALANCE SHEET

Accounts (Accounts payable, Cash & Office equipment – Asset) impacted by March transaction are all balance sheet accounts and thus can be represented on balance sheet as below –

Note. Amounts captured on balance sheet are derived by using the last period’s balance sheet and applying journal entries for this period as highlighted above over it.

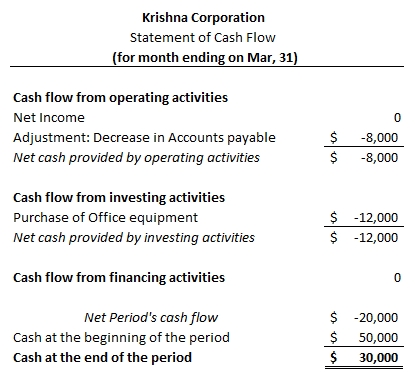

STATEMENT OF CASHFLOW

In this period; company has not borrowed any cash; therefore cash flow from financing activities would be reported as 0.

Company has purchased an asset (office equipment – computer) in this period in a cash deal; resulting in cash outflow of $12,000. Same would be reported under cash flow from investing activities. Cash outflows are captured in negative amounts on cash flow statement.

Due to company’s payment to the supplier for the goods purchased in last period; accounts payable liability on balance sheet has decreased. For deriving cash flow from operating activities, this decrease in accounts payable needs to be subtracted from net income in order to adjust it as per the cash accounting basis.

Therefore, cash flow statement for the March period can be summarized as below –

Note. Derived value of “cash at the end of the period” on cashflow statement must match with cash reserves as captured on the balance sheet for the period.