SUMMARY FOR PREPARING CASHFLOW STATEMENT

Summary of our entire discussion resulting in the preparation of Cashflow Statement is presented in this article.

To re-iterate, preparing Statement of Cashflow requires us to calculate each of the following sections separately and then merge them together to prepare the entire statement.

- Cashflow from Investing activities

- Cashflow from Financing activities

- Cashflow from Operating activities

CASHFLOW FROM INVESTING ACTIVITIES

Investing activities include cashflow from following business transactions –

- Cashflow resulting from sale & purchase of long lived assets (including fixed assets)

- e.g. cashflow resulting from sales & purchase of Property, plant & equipment or marketable securities

- Cashflow resulting from money lending activities (i.e. loans receivables)

CASHFLOW FROM FINANCING ACTIVITIES

Financing activities include cashflow from following business transactions –

- Cashflow resulting from borrowing of cash (short term debt, long term debt, notes payable, bonds etc)

- Cashflow resulting from issuance of securities (common stocks or preferred stocks)

- Cashflow resulting from dividend payments

- Cashflow resulting from purchase of treasury stocks

CASHFLOW FROM OPERATING ACTIVITIES

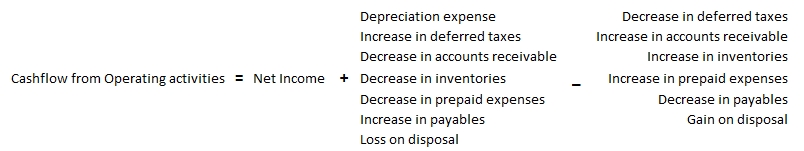

Cashflow from operating activities is derived by applying adjustments to the Net Income using the following rules set –

Note. Increase/ Decrease in payables while calculating cashflow from operating activities to include accounts like accounts payable, wages payable (accrued wages), interest payable (accrued interest expense) & taxes payable. It doesn’t include accounts like notes payable, short term borrowings & current portion of long term debt.

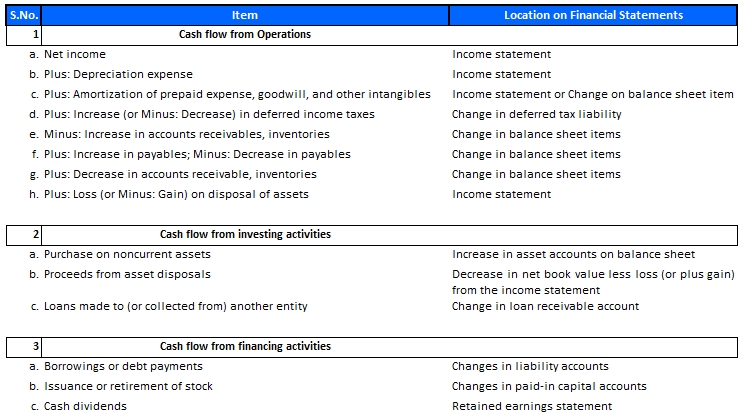

LOCATING AMOUNTS FOR THE PREPARATION OF CASHFLOW STATEMENT

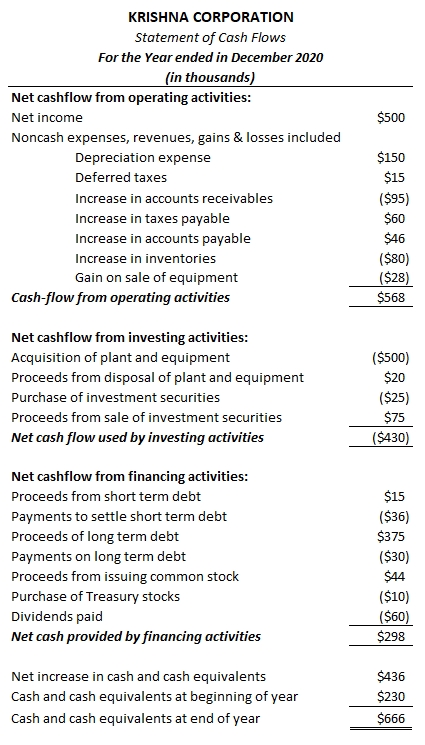

SAMPLE STATEMENT OF CASHFLOW