PREPARING OF CASHFLOW STATEMENT

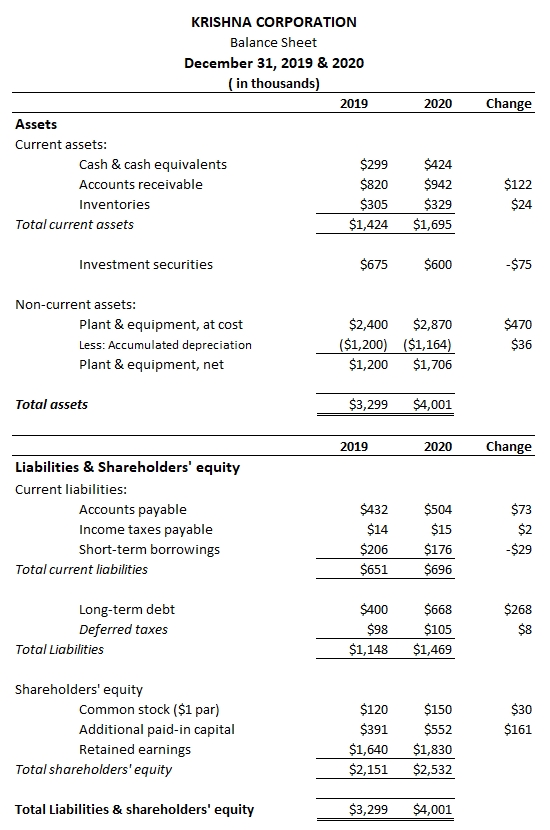

Cash flow statement for an organization is derived from its balance sheet and Income statement. In this article, we will be demonstrating preparation of cashflow statement for Krishna Corporation (FY 2020) using the following balance sheets and income statement as reference –

Balance sheets of Krishna Corporation for the financial year 2019 & 2020 are captured above and subsequent change of values related to all assets & liabilities are calculated on the sheet.

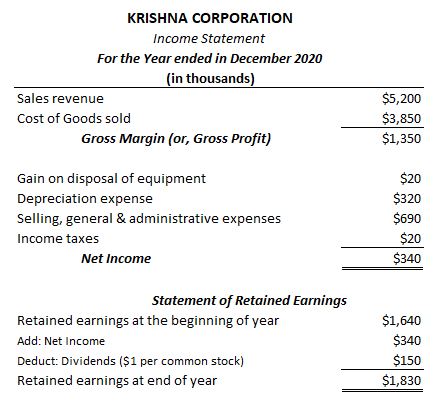

Income statement for Krishna Corporation (FY 2020) is captured as below.

Preparing Statement of Cashflow requires us to calculate each of the following sections separately and then merge them together to prepare the entire statement.

- Cashflow from Investing activities

- Cashflow from Financing activities

- Cashflow from Operating activities

1. CALCULATING CASHFLOW FROM INVESTING ACTIVITIES

As per the theory, investing activities include cash inflows and outflows related to company’s long lived assets like property, plant & equipment, marketable securities etc. Cash flows related to money lending activities (i.e. loans receivables) of the organization are also reported under this section.

On careful observation of balance sheets for Krishna Corporation, you may notice that change in values of Investment Securities & Long-term asset like Plant & Equipment might have resulted in cash flows under this category.

1.1 DERIVATION OF CASH FLOWS RESULTING FROM CHANGES IN MARKETABLE SECURITIES

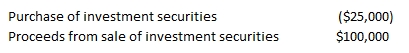

By analyzing balance sheets for the FY 2019 & 2020; you may notice a decrease of $75,000 reported on investment securities. This decrease might be a due to a single transaction where Krishna Corporation must have sold investment securities worth $75,000 during the FY 2020 or it might be a resultant of multiple sale & purchase transactions held by Krishna Corporation on investment securities account during the same period.

In the former case, Cash flow statement would capture following against this change in value for investment securities –

Amount captured above is positive, because selling marketable securities will bring cash inflows for the organization.

On the other hand, if $75,000 is the net effect of selling $100,000 worth marketable securities (at cost) and purchasing $25,000 worth of it; cash flow statement must capture following records –

In either of the cases, the net effect on cash flows from investment securities remains the same at $75,000.

In a real life scenario, whether this change in balance sheet amount is due to a single transaction or a resultant of multiple transactions, can be identified by an accountant on drilling down the ledger transactions affecting investment securities account for Krishna Corporation in the same period.

Note. Cash inflows and outflows related to a specific type of asset must be shown as separate gross transactions on the cash flow statement rather than as a single net transaction.

1.2 DERIVATION OF CASH FLOWS RESULTING FROM CHANGES IN LONG LIVED ASSETS

To understand cashflow resulting from change in long lived assets, consider the below example –

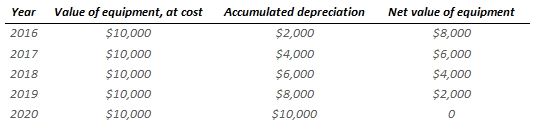

Example. XYZ Corporation bought an equipment called asset #1 at the end of year of 2015 for $10,000 and with a useful life of 5 years. If the corporation uses straight line depreciation; expected depreciation plan for this asset#1 can be drawn as below –

At the year end of 2018, XYZ Corporation decides to upgrade this equipment by replacing it with alternate high capacity equipment called asset #2. The corporation purchased asset#2 at price point of $20,000 and sold old asset#1 in the market for $2,500.

Considering the given narrative, you can easily figure out that the above purchase & sale transactions of asset #2 & asset #1 resulted in the net cash outflow of $17,500 ($20,000 – $2,500) for XYZ Corporation.

Same can be verified using journal entries as well. Journal entries for purchase transaction of asset #2 can be captured as below –

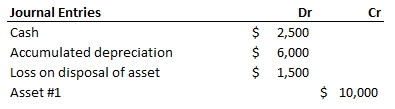

And that for the sales transaction of asset #1 can be captured as below –

Considering the net effect of above two transactions on cash account; it is evident that XYZ Corporation witnessed a cash out flow of $17,500.

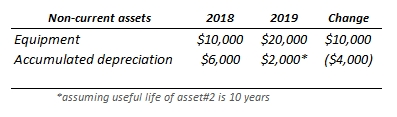

On balance sheet; these transaction would be reported as follows –

The objective of this entire narrative was to make you understand that any kind of change as witnessed in case of long lived assets on balance sheet does not translate or depicts the actual cash flows happening behind the scene directly.

In order to derive cash flows for long lived assets; one must drill down the ledger entries reported under these individual asset accounts and identify the amounts spent on purchase and gains on disposal of these assets separately.

In our case, on analyzing balance sheets for changes in long-lived assets (in our case – plant & equipment), you may notice an increase of $470,000 in the FY 2020 for Krishna Corporation.

This increase again can be understood as the net effect of purchase & disposal of multiple long-term assets by Krishna Corporation during the Period. To identify the actual assets & the transactions, the accountant must further drill down this account and identify amounts spent on purchases and gains on disposal of these assets separately.

On studying the books in detail, the accountant figures out that $827,000 was spent on the purchase of a new equipment which replaced an old equipment having an original cost $357,000 (with zero useful life left); thus resulting in $470,000 net increase. (Note – $357,000 is the original cost of the old equipment and not its current net book value).

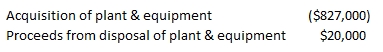

If the old equipment was disposed at $20,000 in the period; entries reflecting in cash flow statement due to change in asset will be recorded as –

Thus, these transactions will result in $807,000 net cash outflow.

Purchase of a new asset will result in cash outflow; therefore $827,000 is reported above as a negative amount. Similarly cash in-flows would be captured as positive amounts.

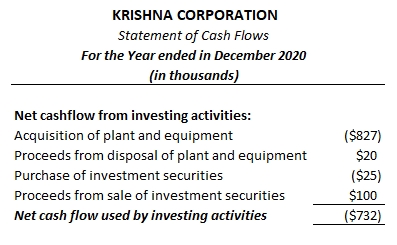

There are no other long-term asset accounts on this balance sheet; therefore cash flows from the investing activities for Krishna Corporation during the FY 2020 can be summarized as below –

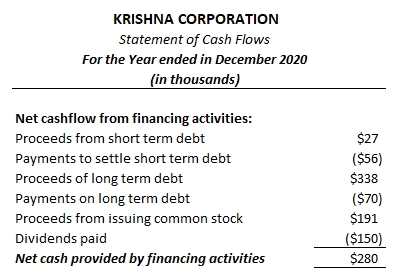

2. CALCULATING CASHFLOW FROM FINANCING ACTIVITIES

This section on cash-flow statement includes cash inflows and outflows resulting from transactions related to borrowing of cash (in form of short-term debt, long term debt, notes payable, bonds etc) and the issuance of securities (common stocks or preferred stocks). Transactions related to dividend payments to shareholders and purchase of treasury stocks are also reported under this section.

From the balance sheet, it is evident that Krishna Corporation’s short term borrowings have decreased by $29,000 over the period 2019-20. Assuming this net effect is caused by Proceeds (Purchase) from $27,000 worth short term debt and payments to settle $56,000 short term debt; cash flow statement would capture following records –

Payment of short term debt will result in cash outflow; hence the amount is captured in negative.

Similarly, long term debt has a net increase of $268,000; on drilling this account further, it was found that it is the result of Proceeds (Purchase) of $338,000 in long-term debt and Payment to settle $70,000 of it; which can be recorded on cash flow statement as –

Availing (purchase) of long–term debt will result in additional cash in-flows; therefore the amount captured is positive. Similarly, payments made to settle debt amount will result in cash outflow; hence captured as negative.

Next in line is payment of dividends. From the statement of retained earnings (within income statement); it can be found that Krishna Corporation paid $150,000 as dividends during the period 2019-20. Therefore, cash flow statement must record an entry as follows for this transaction –

Dividend is paid out to the shareholders of the organization; hence results in cash outflow. Therefore it is captured as negative.

Next comes is raising of investments through issuance of securities. Balance sheet shows that common stock value (at $1 par) has increased from $120,000 to $150,000. Therefore, Krishna Corporation has issued 30,000 new common stocks during year 2019-20. These new stocks has brought in $30,000 of additional capital in form of common stocks (sold at $1 par) and $161,000 of additional paid-in capital, raised from selling these stocks at premium (at a amount > $1 par value). Thus; cash flow statement would record for this transaction –

Raising funds by issuing new securities will result in cash inflow for the organization; hence this amount is captured as a positive value.

There is no other transaction related to borrowing of cash or payment of debt on this balance sheet & income statement; therefore cash flows from the financing activities for Krishna Corporation during the year 2019-20 can be summarized as below –