COMPONENTS OF A BALANCE SHEET

At a broad level, components on a balance sheet can be classified into following categories –

- Assets

- Liabilities

- Shareholders’ equity

Following sections provides an in-depth explanation for each of these components.

1. ASSETS

Economic resources whose fair value can be objectively measured are termed as assets. Assets when purchased and controlled by an entity provide future benefits to it.

Example. XYZ Corporation is a manufacturing company. Cash held by it in its bank accounts will be termed as assets as it can be used to purchase other resources. Similarly, manufacturing equipments, machinery, land etc owned by the company will also be termed as assets as these can be used to produce final products which can be sold in market in exchange of cash.

However, bad goods or expired merchandise won’t be considered as an asset, (even though it is owned by business) because it cannot be used to generate revenues.

A few examples of the asset accounts are cash, accounts receivable, market securities, prepaid insurance, land, property plant & equipment, inventory, goodwill etc.

CLASSIFICATION OF ASSETS

Assets are reported in a well classified manner on the organization’s balance sheet. As per the US GAAP guidelines, following asset categories can be used for identifying asset type and reporting them –

- Current assets

- Property, Plant & Equipment (Fixed assets)

- Intangible assets

- Investments

CURRENT ASSETS

Current assets are the economic resources of an entity that are expected to realize in cash in near future (within the operating cycle of the organization). Operating cycle period for most business entities is of one year; however there are a few exceptions to it. E.g. tobacco and liquor remain in inventories as current assets for two or more years because of the aging process related to these products.

A few examples of current assets are cash, petty cash, accounts receivable, inventories, marketable securities, notes receivable, prepaid expenses etc.

Funds present in entity’s bank accounts and available for immediate disbursement as required are termed as Cash. Small amount of funds that an entity holds on its premises to manage day to day expenses are termed as Petty Cash.

Marketable securities are the short term investments made by an entity to earn some interest on its otherwise idle cash. These investments are likely to get converted into cash within the operating cycle of the organization.

Accounts receivable is the amount that customers owe to the company and is expected to be received within its operating cycle. This account is reported on balance sheet along with contra-asset account called Allowance for doubtful accounts. This contra-asset account factors in, a portion of accounts receivable that probably will never be collected from customers.

Amounts owned by parties other than customers are reported under notes receivable or other receivables account.

Prepaid expenses are the assets, usually intangible whose usefulness will expire in the near future. E.g. Insurance policy

The goods that company owns and would be sold in the normal course of business are reported under inventory account. These goods include items that are either ready for sale or in the process of production or even at raw material stage.

Example. Car offered for sale by a car manufacturer is an inventory; but same car used by a motor mechanic to make service calls is not an inventory (as primary activity of a motor mechanic is to provide auto repair & maintenance service and not selling cars). It would be classified as equipment, under non-current assets group on balance sheet in the later case.

PROPERTY, PLANT & EQUIPMENT (FIXED ASSETS)

This category of assets is considered to be long-lived and was acquired by the company in order to use them to produce goods & services that will generate future cash flows. Examples of fixed assets are land, buildings, equipment, vehicles etc

INVESTMENTS & INTANGIBLE ASSETS

Investments are amounts invested by a company into another company either to control it or in anticipation of long term return. These are differentiated from Marketable securities which reflect short term use of excess capital.

Intangible assets include goodwill, copyrights, patents, franchises, trademarks and other similar valuable but non-physical items that are controlled by the company.

Note. Goodwill & Trade-names occur on the balance sheet of an entity only in case when one entity purchases another entity and pays a price which is more than the market value of its net assets (market value of net assets = sum of market value of all assets – sum of market value of all liabilities). The amount by which the purchase price exceeds the market value of the acquired company’s net assets is reported as Goodwill. Goodwill represents the brand value, reputation, clientele or other similar intangibles linked to the acquired company for which acquirer entity is willing to pay a premium.

Goodwill & Trade-names will never appear on an entity’s balance sheet unless it has actually purchased another entity by means of an acquisition.

Example. Philip Morris accounts recorded $2.8 billion in their books as goodwill after they acquired General Food Corporation for $5.8 billion. This goodwill amount can be interpreted as brand value of various brands (Good Seasons, Jell-O, Maxwell House, Kool-Aid) originally owned by General Foods.

Important point to note here is that General Foods have never recognized goodwill as an asset on its book.

Asset accounts usually will have debit balances. Contrary to asset accounts are contra-asset accounts. The values captured in these contra-asset accounts are usually subtracted from typical asset accounts. Examples of contra-asset accounts are –

- Accumulated depreciation (for land improvements, building, equipment etc)

- Allowance for doubtful account

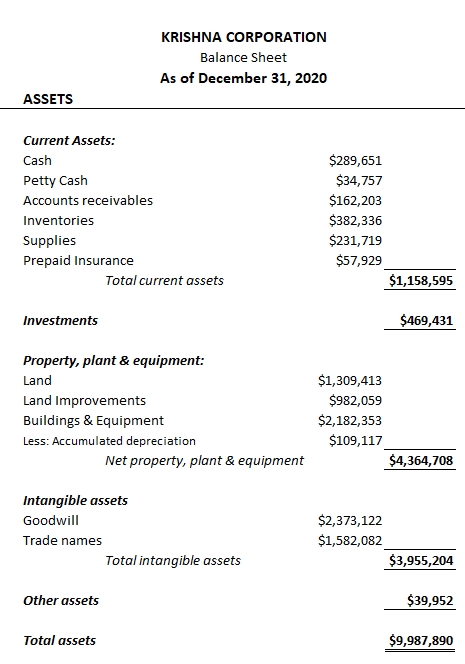

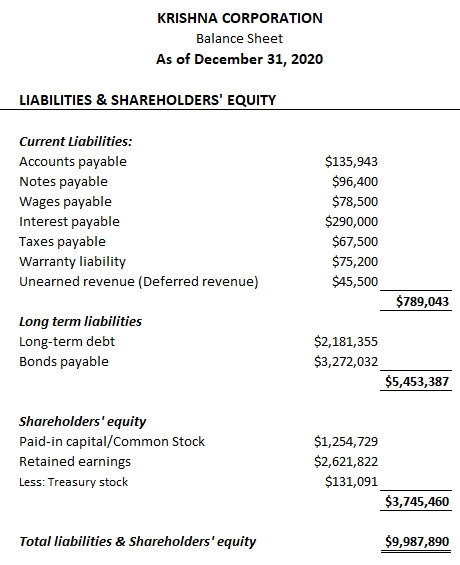

Contra-asset accounts have credit balances. Asset portion of balance sheet for Krishna Corporation is captured as below for reference –

2. LIABILITIES

The amount owed to creditors for past transactions are captured under liability accounts on balance sheet. These amounts can be seen as an obligation for the organization.

Liabilities are sometimes also viewed as claims of creditors against company’s net assets. On balance sheet they are classified under following two categories –

- Current liabilities

- Long-term liabilities

CURRENT LIABILITIES

Current Liabilities are the obligations of the organization which are expected to be settled during the normal operating cycle or within one year (whichever is longer).

A few examples of current liability accounts are accounts payable, taxes payable, salaries payable, Interest payable, deferred revenues, warranty payable, notes payable, accrued expenses, current portion of long term debt etc.

Unpaid claims of the suppliers against the goods or services provided in the past to the company are reported under accounts payable. These claims are usually unsecured and are expected to be settled within the operating cycle of the business.

Notes payable (short-term debt) represents the amount that is owed by the company to the financial institutions. These can be seen as short term loans taken by the company.

The unpaid amounts that have been earned by the outside parties in exchange of past services or lending are termed as accrued expenses. These are the amounts for which company either has not yet received invoices from parties or invoices are not at all required for payment for these services.

Example. Interest earned by a lender but not yet paid by the company falls under the category of accrued expenses. Similarly unpaid salaries or wages owed to employees in exchange of their work services are also reported under accrued expenses.

At times, more descriptive terms like Interest payable, salary payable or wages payable are used on balance sheet to represent this type of expenses.

Current portion of long term debt due for payment within the current operating cycle is also reported under this financial head on the balance sheet.

Customer deposits or advances received by a company for future services are also reported as liability. These amounts are not yet earned by the company, hence are not reported as revenues. Under normal practice, they are deferred for reporting till the period when service is provided (or product is delivered); until then they are reported as liability under unearned revenue or deferred revenue account on balance sheet.

LONG TERM LIABILITIES (NON-CURRENT LIABILITIES)

Liabilities that are expected to settle over periods longer than the operating cycle of the business like Long–term debts, bonds payable etc are categorized under non-current liabilities and reported separately on the balance sheet.

Liability accounts have credit balances. Contrary to liability accounts are contra-liability accounts. The values captured in contra-liability accounts are usually subtracted from typical liability accounts. Examples of contra-liability accounts are –

- Discount on Bonds payable

- Discount on Notes payable

- Bond or Debt issue costs

Contra-liability accounts have debit balances.

COMMITMENTS

Commitments made by a company on legal grounds (such as by signing a contract for purchase of future goods or services) are not considered or reported as liability on the balance sheet. However in case, significant amount is involved in these commitments; they should be clearly reported as Notes to Financial statements.

CONTINGENT LIABILITIES

Contingent liabilities are the potential liabilities for a company. They may or may not become a liability in future. Examples of these types of liabilities are lawsuits filed against a company, warranty provided on company’s products & the guarantee provided by the company on a loan taken by another party.

Contingent losses must be reported under liabilities on balance sheet in case the likelihood of its occurrence is significant. In case the likelihood is remote, it can be ignored. In cases where no clear likelihood can be drawn, these should be disclosed in the notes to financial statements.

3. STOCKHOLDERS' EQUITY (OWNERS' EQUITY)

Owner’s equity section on balance sheet captures the amount of money as invested directly in the entity by the owners of the organization. The term owner’s equity is used only for the unincorporated (unregistered) entities or sole proprietorships.

For corporations, this investment is made by investors through the purchase of company shares. Therefore, the section is termed as stockholders’ equity or shareholders’ equity on corporate balance sheets. This amount sometimes is also referred to as the book value of the company.

Amounts captured under stockholders’ equity section on corporate balance sheets are divided into following categories –

- Paid-in capital

- Retained earnings

PAID-IN CAPITAL

Paid-in capital is the amount raised by the company by selling its shares to the investors. This raised capital is further divided into two components –

- Capital stocks

- Additional paid-in capital

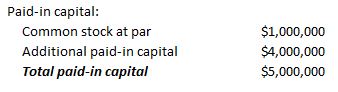

Each share listed by a corporation for investors has a par value (or face value). Capital stocks show this value per share times the number of outstanding shares. If the investors pay more per share to the corporation than this stated par value; the excess is shown separately as additional paid–in capital on balance sheet.

Example. Krishna Corporation has 1 million shares of common stock outstanding with a par value of $1 per share. Considering the reputation of the company, if these shares were purchased at $5 million by investors; the Shareholders’ section of balance sheet would like below –

RETAINED EARNINGS

Investors (who invest in shares of the company), are practically owners of the organization. Therefore, theoretically speaking any profits (or net income) reported by the organization at the end of its business cycle must be distributed amongst its investors in proportion of their ownership. These payouts are normally termed as dividends and are distributed annually.

However, important point to note here is that in reality, not all of the profits generated by the company are distributed to its shareholders as dividends. A significant portion of it is retained by the company for future investments. This retained capital is reported under retained earnings section on the balance sheet.

Stockholders’ equity or owners’ equity accounts have credit balances.