DEFERRED REVENUES

Under the accrual method of accounting, the amounts received in advance of being earned must be deferred to a liability account until they are earned. Unearned Revenues (or Deferred Revenue) is a liability account that reports the amounts received by a company but have not yet been earned by the company.

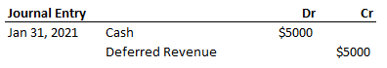

Say a company received an amount of $5000 as advance in the month of January, 2021 for the service to be performed in February, 2021. This amount will certainly increase the cash reserve of the company by $5000 but it cannot be reported as service revenue for the period of January, since the actual service would be provided only in February. In the month of January, this amount is to be reported as a liability under Deferred revenue (or Unearned revenue) account.

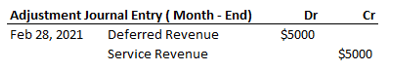

Now at the end of February, 2021, when the service is performed, the following adjustment entry needs to be reported in the system in order to maintain the accuracy of the financial statements:

Here, the liability (Deferred Revenue) reported in the last month has to be reversed and instead service revenue has to be booked.

DEFERRED EXPENSES

Under the accrual method of accounting, any payments for future expenses must be deferred to an asset account until the expenses are used up or have expired.

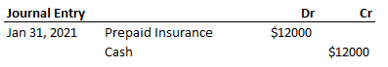

Say a company bought an annual insurance for $12000 on 1st January, 2021. Here, since $12,000 of payment is made for future expenses (insurance is valid for next 12 months), it must be deferred to an asset account (in this case, Prepaid insurance account).

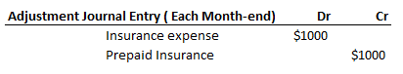

Although the company has paid the entire premium upfront, still the insurance is valid for next 12 months.

In each of the months January through December, the company must reduce the asset account by recording the following adjusting entry:

DEPRECIATION EXPENSES

Depreciation is associated with fixed assets like property, plant & equipment. The cost for this category of assets is expense-off throughout their useful life (instead of the period in which they are purchased).

As an example, consider a company purchased an office equipment worth $60,000 with a useful life of 5 years (i.e. 60 months). Although, the company paid $60,000 upfront, still all of this amount won’t be expense-off in its period of purchase, rather an asset worth $60,000 would be created in books and be depreciated (or expense-off) each month for an amount $1000. ($60,000/ 60 months).

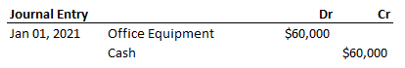

At the time of its purchase, following journal entry would be reported in the system:

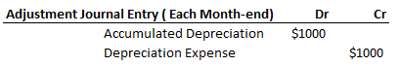

At the end of each month, an adjustment entry would be required in system to reduce the asset value and transfer it to the expense account. This entry would be as follows:

Accumulated Depreciation is the contra-asset account that is used to capture the depreciation amount on the balance sheet. On the other hand, depreciation expense would be captured on the income statement.

Note. Balances in the Balance sheet accounts like deferred revenue, accumulated depreciation etc. are carry forwarded to the next accounting year whereas balances in the income statement accounts like depreciation expense etc. are closed when the current year is over. Revenues and expenses always start the next accounting year with $0.

Table of Contents : Accounting Principles

Accounting Principles & guidelines