HOW ACCOUNTING PRINCIPLES AFFECT FINANCIAL STATEMENTS

Accounting Principles standardize the process in which the financial statements are prepared. In this section, we will discuss the effect of how these principles influence the preparation of –

- Income Statement

- Balance Sheet

- Notes to Financial Statements

1. INCOME STATEMENT

Income statement summarizes the expenses and the revenues of an entity for a specified accounting period. This period could be a quarter, a month or a full year. The statement is also known by the names like profit & loss statement, statement of operations and statement of earnings.

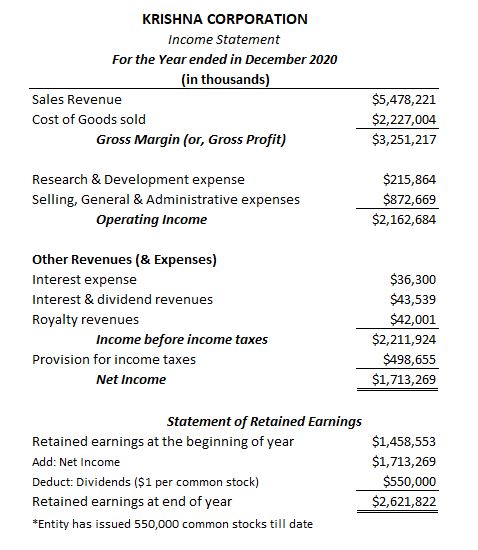

A simplified version of a profit & loss statement looks like the one below –

Matching principle & Revenue Recognition Principle are the two strong forces that steer accountants to use accrual accounting basis for reporting. Revenue recognition principle allows accountants to recognize revenues in the period when they are earned rather than when the money was actually received and the matching principle requires expenses to be either matched to revenues or be reported in the accounting period in which they were consumed. Thus these two principles lay foundation stones to the basis as per which revenues and expenses on an income statement gets captured.

2. BALANCE SHEET

Balance sheet reflects the asset and the equity (liability & shareholders’ equity) holdings of an organization at a specified moment in time. It is also referred by the name statement of financial position.

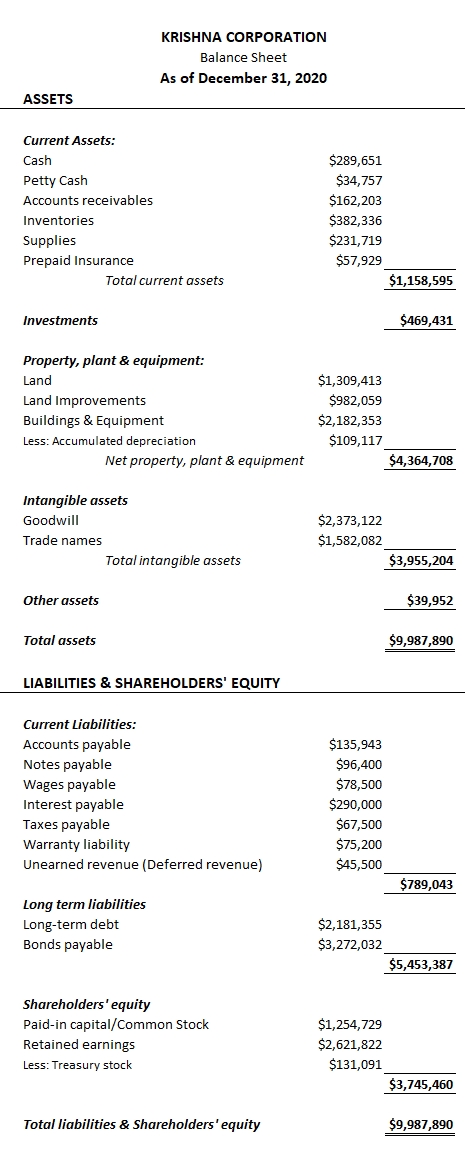

A sample simplified balance looks like the one given below –

A business entity is different from its owner by economic entity assumption. Therefore, only the assets owned by the entity and liabilities related to business operations are captured in this financial statement. This statement has no place to capture personal non-business transactions/assets of its owners.

The value of the assets reported on this balance sheet is their original procurement cost. No appreciation or inflation related adjustments are ever imposed on these values. This is done in accordance with the cost principle as explained in earlier articles. As per the balance sheet, Krishna Corporation owns a land asset recorded at approximately $1.3 million. This should be interpreted as the cost of purchase of that land. It has no relation to the current market value of that land at present. In case, the entity decides to purchase another land; the purchase price of the additional land needs to be simply added to this price to derive the new reported cost of land on the balance sheet.

Conservatism principle states that if an accountant faces a situation where he has to select from two or more acceptable alternatives for reporting a transaction; the preference should be given to a larger number when measuring liabilities and expenses and to a smaller number when reporting assets or revenues. This principle allows accountants to anticipate and report losses early but wait for gains unless they are certain (or actually happen). E.g. Krishna Corporation reported an inventory of $382k at the end of December 2020. If the current cost of same items in inventory drops significantly in the market to say $200k; the conservatism principle instructs the company to write down its inventory cost to $200k and report a loss on its income statement.

The Supplies account & prepaid insurance account shown on balance sheet represents the cost values of these heads which are unused or not yet expired. These values will be booked under supplies expense account & insurance expense account respectively on income statement as these heads get consumed (in case of supplies) or expired (in case of insurance). This is done in accordance to the matching principle that requires expenses to be either matched to revenues or be reported in the accounting period in which they were consumed depending on whether it has “cause & link” affect with the revenue. Also, this deferring of expenses in the balance sheet is possible due to another principle called the going concern principle.

Certain critical assets of an entity like its own trade names, goodwill or logo etc cannot be reported on its balance sheet due to monetary unit assumption as they were never purchased. Therefore, practically Nike’s logo might be a very valuable asset for the company; but it can never be reported on its balance sheet as an asset.

Above point may raise confusion amongst students starting with financial accounting because the balance sheet shown above does report goodwill and trade–names as assets on its balance sheet contrary to the statement we made above.

TREATMENT OF GOODWILL & TRADE-NAMES ON BALANCE SHEET

Goodwill & Trade-names occur on the balance sheet of an entity only in case when one entity purchases another entity and pays a price which is more than the market value of its net assets (net assets market value = sum of market value of all assets – sum of market value of all liabilities). The amount by which the purchase price exceeds the market value of the acquired company’s net assets is reported as Goodwill; representing the brand value, reputation, clientele or other similar intangibles linked to the acquired company. Goodwill & Trade-names will never appear on an entity’s balance sheet unless it has actually purchased another entity by means of an acquisition.

Example. Philip Morris accounts recorded $2.8 billion in their books as goodwill after they acquired General Food Corporation for $5.8 billion. This goodwill amount can be interpreted as brand value of various brands (Good Seasons, Jell-O, Maxwell House, Kool-Aid) originally owned by General Foods.

Important point to note here is that General Foods have never recognized goodwill as an asset on its book.

3. NOTES TO FINANCIAL STATEMENTS

The full disclosure principle bounds the accountant to disclose all the relevant information that can hamper or affect the decision making of investors, creditors and other stakeholders in the entity within the notes of the financial statements.

Table of Contents : Accounting Principles

Accounting Principles & guidelines