EXPLANATION OF VARIOUS HEADS ON INCOME STATEMENT

The format of income statements may vary depending on operational complexities of the organization. However, more or less each income statement generated as per US GAAP guidelines is likely to have following sections –

- Revenues

- Expenses

- Gains & Losses

1. REVENUES

At a broader level, revenue sources of an organization can be categorized into following –

- Revenue from Primary activities (Operating Revenue)

- Revenue from Secondary activities (Non-Operating Revenue)

REVENUES FROM PRIMARY ACTIVITIES

The revenue earned by conducting core or primary activities of a business is reported under this head. Terms like revenue, sales revenue, service revenue or net sales are interchangeably used on income statement to represent operating revenue by organizations. Revenue from primary activities is also referred to as Operating Revenue.

Example. The primary activity for a car manufacturer would be production and sales of cars and that of a trader would be purchase and re-sale of merchandise. Similarly delivery of professional services would be considered as a primary activity for a consulting firm.

REVENUES FROM SECONDARY ACTIVITIES

The revenue earned from non-core or secondary activities of a business is reported under this section. Revenue from secondary activities is also referred to as Non-Operating Revenue.

Example. A car manufacturer has commission based tie up with an insurance company for selling car insurance along with the sale of its cars. Such activities are non-core activities for the car manufacturer and revenue earned by these activities are categorized under non-operating revenue.

Similarly, interest earnings on idle cash and rentals from a vacant space etc for a retailer will be categorized under non-operating revenue.

Non-operating revenue, just like operating revenue is also reported in the accounting period in which it is earned and not when the cash is received.

2. EXPENSES

Similar to revenue, expenses of an organization too can be broadly categorized into the following –

- Expenses involved in Primary activities (Operating Expense)

- Expenses involved in Secondary activities (Non-Operating Expense)

OPERATING EXPENSE

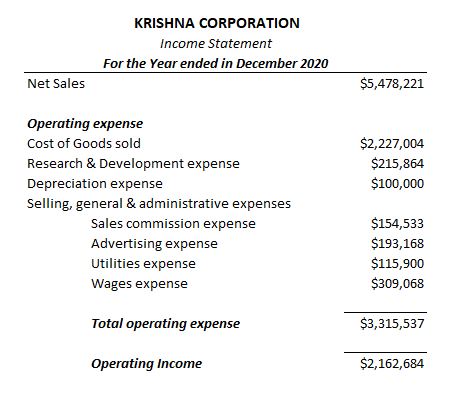

The expenses incurred to earn operating revenue or to facilitate primary activities of an organization are categorized under operating expense. Selling, general & administrative expense (SGA) [includes expenses like sales commission expense, advertising expense, wages expense, utilities expense etc] is an ideal example of this type of expense.

Under accrual basis of accounting, matching principle requires these expenses to be either matched to the operating revenues or to be reported in the accounting period in which they were consumed (for products) or expired (for service).

Expenses that have cause & effect linkage with revenues are to be matched and reported along them in the accounting period where the revenue is earned (And not in period where the expense was incurred).

Example. cost of goods sold (COGS) and sales commission expense can be linked to revenues and thus must be reported in period where the related revenue is earned and not in periods when these amounts were actually paid.

On the other hand, expenses that can’t be directly co-related to revenues are to be reported in the accounting period in which they are incurred.

Example. marketing & advertising expense, insurance, rent, depreciation expense, utilities expense, wages expense, research & development expense etc are to be reported on income statement in the period when they are incurred.

One must not confuse cash disbursements with the recognition of expenses on the income statement.

Example. Cash disbursement of $50,000 by an organization to reduce bank loan will not be reported as expense. It is an amount paid by the organization to reduce its debt (liability).

There are following four ways in which a cost can be reported as an expense on income statement –

- When the cost head can be linked to revenue (e.g. cost of goods sold & sales commission expense)

- When the cost head has expired or consumed (e.g. depreciation expense, Prepaid insurance (asset) to be expensed off as insurance expense on expiry of service)

- When the cost head doesn’t have any measurable future value (e.g. advertising expense)

- When cost value for an asset is too small to be allocated to future periods (e.g. The cost of a $500 printer bought by multi-million dollar company would be expensed off immediately under SGA expense head on income statement as relatively this cost is too trivial to be allocated to future periods)

NON-OPERATING EXPENSE

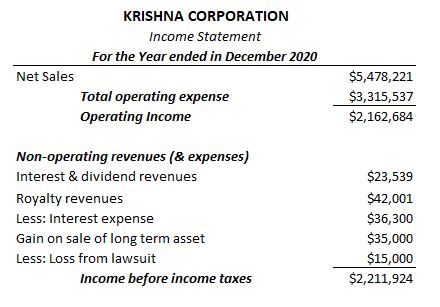

Expenses involved in facilitating secondary activities of an organization are termed as non-operating expense.

Example. Interest expense is a non-operating expense because it is related to the finance function of the business and not directly related to primary activities of buying and selling goods

3. GAINS & LOSSES

Gains & Losses are reported on income statement to capture revenue or loss generated from the sale of long term assets (including marketable securities) of an organization or to capture the affect of a lawsuit that got settled in the reported accounting period. Gains & Losses can be clubbed together with non-operating revenue & expenses while reporting on income statement.

GAINS

In case of sale of long term asset, Gain would be reported as net of the proceeds as received from the sale minus the remaining book value of the asset.

Example. Each asset used by an organization is marked with a useful life over which asset value is completely depreciated. Say a stationery manufacturing company XYZ Corporation bought an equipment (asset) for $100,000 with useful life of 4 years in the year 2016. Using straight line depreciation, asset value would be depreciated by $25,000 each year. Remaining net book value of the equipment by the year end of 2019 would be $25,000.

In the year 2019, company decides to upgrade its technology and replace this equipment (asset) with an upgraded version. If the company sells their existing equipment (asset) for $30,000 by the year end of 2019, their “gain on sale of equipment” would be reported as $5000 (Sale price – net book value) on its income statement generated for this accounting period. (Assume uninstallation cost of equipment and cost of selling are insignificant)

Note. This $5000 of additional income can’t be reported as sales revenue because company has not earned it by conducting its primary activity which in this case is production and sale of stationery items.

If a company sells market securities for a price more than what they were purchased at; such increase in income are to be reported as gains on income statement.

In case of a settled lawsuit, Gain would be reported as the direct monetary benefit that the organization would cash-in because of the favored decision of the lawsuit.

LOSSES

In case of sale of long term asset, if the book value of the asset is greater than the proceeds as received from the sale; a loss would be reported for this transaction in income statement.

Example. A stationery manufacturing company XYZ Corporation bought an equipment (asset) for $100,000 with useful life of 4 years in the year 2016. Using straight line depreciation, asset value would be depreciated by $25,000 each year. Net book value of the equipment by the year end of 2019 would be $25,000.

In the year 2019, company decides to upgrade its technology and replace this equipment (asset) with an upgraded version. If the company sells their existing equipment (asset) for $30,000 by the year end of 2019 and spends $6000 for the conducting the auction, their “loss on sale of equipment” would be reported as $1000 (Sale price – net book value – cost associated with selling) on its income statement.

Similarly in case of settled lawsuit, a loss would be reported if the decision has been granted against us resulting in cash outflow for the organization.

IMPAIRMENT LOSSES

When the fair market value of a long term asset declines significantly below its net book value, the accountants chose to reduce the value of the asset in books and an impairment loss is reported on Income statement. Impairment loss is reported for both tangible as well as intangible assets.

Example. On January 2015, a specialized equipment was purchased by a company at $1 million with useful life of 6 years. The equipment was depreciated using straight line method.

By January 2018, the company realizes that the fair value of this equipment has dropped in the market to $200,000 which is significantly lower than the reported net book value of the equipment ($500,000*). Therefore, the company needs to write down the book value of this asset to $200,000 and report an impairment loss of $300,000 ($500,000 – $200,000).

*Net book value of the equipment would be reduced to half of its original cost at the end of three years (i.e. in January, 2018) considering adjustments for depreciation.

Example. A company XYZ Corporation acquired another company “ABC solutions” at a price over and above the fair price of its net assets. This extra price paid for acquisition was reported in balance sheet of XYZ Corporation as “Goodwill” (asset). This amount captured as goodwill is assumed to remain constant and is therefore never amortized to expense.

However, each year the company must assess this value and if a negative adjustment is required; value of this asset must be decreased in books and an impairment loss must be reported.