INTRODUCTION TO CASHFLOW STATEMENT

A separate document for reporting cash flows is required because of accrual basis accounting being used by most of the corporate companies for financial reporting. Under accrual basis of accounting, a company is required to report the revenues as soon as they are earned; regardless of when the money is actually received.

Thus, the income statement provides insights only of how a business is doing in terms of revenue & expenses. It doesn’t report any information on the company’s actual cash inflows and outflows. Therefore there is a need for a separate financial statement to address this gap called statement of cash flows (SCF).

Statement of Cashflows tracks cash inflows and outflows and provides a fair idea of net cash reserves added or lost in an accounting period for an organization.

The transactional records captured on a cash-flow statement are categorized into following:

- Cash flows from investing activities

- Cash flows from financial activities

- Cash flows from operating activities

- Supplemental information/ disclosures

It is important to note here that the values for the above sections are not directly derived from cash & cash equivalent accounts but rather are inferred from the income statement and the balance sheet. This method is adopted to reduce the complexities involved in continuously tracking cash accounts for different cost and revenue heads.

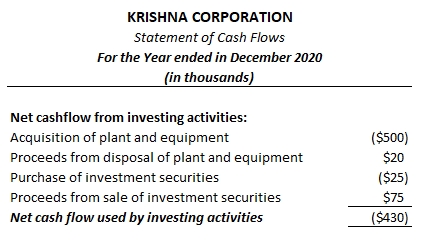

CASHFLOW FROM INVESTING ACTIVITIES

This section includes cash inflows and outflows related to company’s long lived assets like property, plant & equipment and marketable securities etc. Cashflows related to money lending activities (i.e. loans receivables) of the organization are also reported under this section.

Below is the example of what this section might look like on a cash flow statement –

Negative amounts captured under this section indicate cash outflow transactions and positive amounts represent cash inflow transactions.

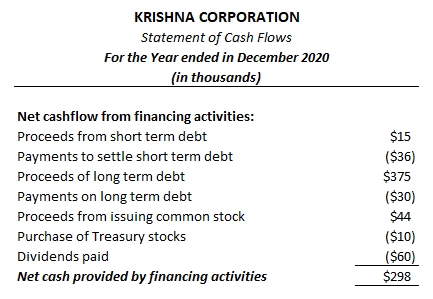

CASHFLOW FROM FINANCING ACTIVITIES

This section on cash-flow statement includes cash inflows and outflows resulting from transactions related to borrowing of cash (in form of mortgages, notes payables, bonds etc) and the issuance of securities (common stocks or preferred stocks). Transactions related to dividend payments to shareholders and purchase of treasury stocks are also reported under this section.

Below is the example of what this section might look like on a cash flow statement –

Negative amounts captured under this section indicate cash outflow transactions and positive amounts represent cash inflow transactions.

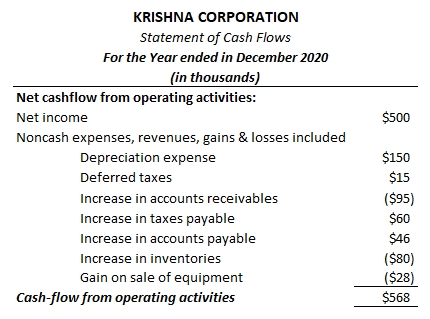

CASHFLOW FROM OPERATING ACTIVITIES

All the activities of an organization that is neither financing nor investing are classified under operating activities. This section captures the cash flows related to ongoing business activities in the reported period.

Cash flows from operating activities can be calculated using indirect method, which nullifies the effect of accrual accounting on the net income by applying several adjustments to it. These adjustments are derived by analyzing amounts reported on income statement (of current period) and by considering changes of various current asset and liability heads as reported on the balance sheet.

Below is the example of what this section might look like on a cash flow statement –

It starts by reporting Net income from the income statement followed by several adjustments heads as captured above.

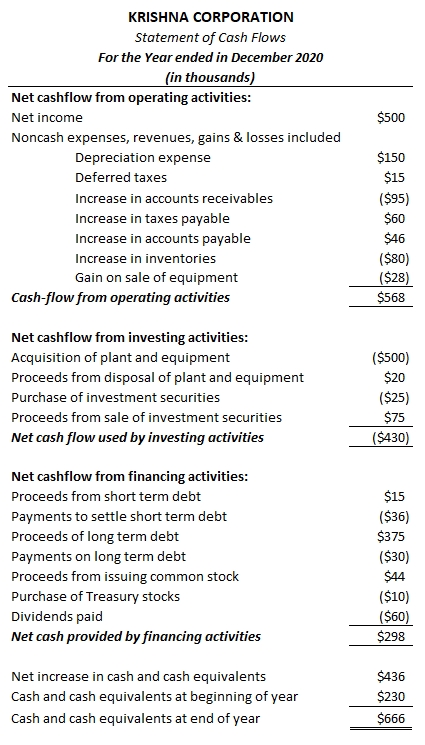

STATEMENT OF CASHFLOW : FORMAT

A simplified version of statement of cash flows is presented in this section. It reports cash inflows and outflows for the organization under operating, investing & financing heads. At the end of the statement cash equivalent at the period’s end is derived by adding net increase/decrease of cash during the period to the cash equivalent of the previous period.

For simplification of the statement, we have omitted the Additional information section (Notes to Financial Statement) which would otherwise be captured on this statement in a real world scenario. Additional Information section on SCF provides information regarding the assumptions made while preparing the statement and details of non-cash transactions like exchange of shares for bonds payable, conversion of convertible bonds into common stock etc.