PREPARING OF CASHFLOW STATEMENT (Contd ...)

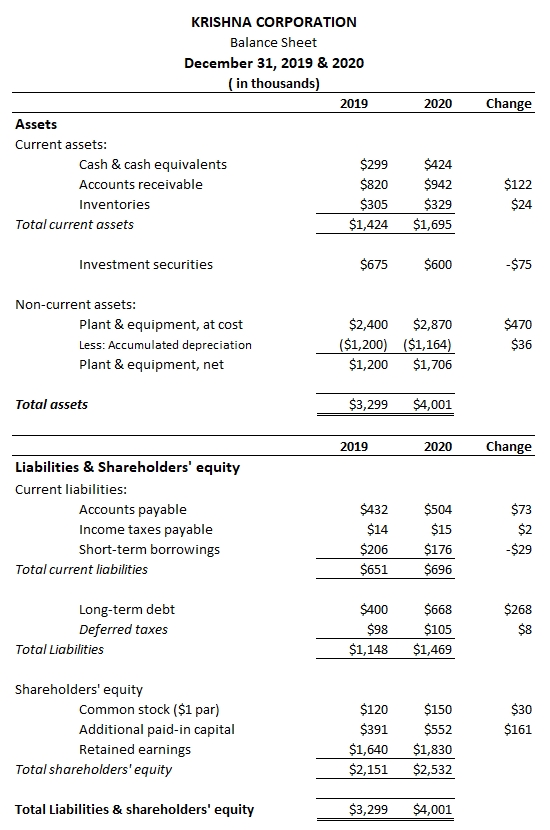

Cash flow statement for an organization is derived from its balance sheet and Income statement. In this article, we will be demonstrating preparation of cashflow statement for Krishna Corporation (FY 2020) using the following balance sheets and income statement as reference –

Balance sheets of Krishna Corporation for the financial year 2019 & 2020 are captured above and subsequent change of values related to all assets & liabilities are calculated on the sheet.

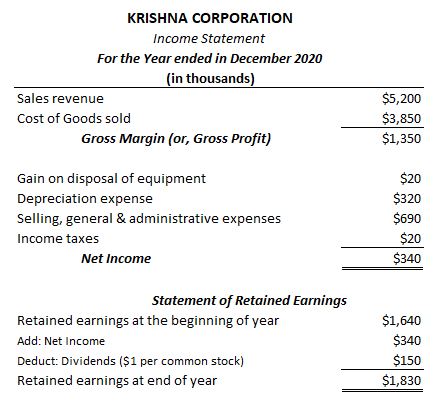

Income statement for Krishna Corporation (FY 2020) is captured as below.

Preparing Statement of Cashflow requires us to calculate each of the following sections separately and then merge them together to prepare the entire statement.

- Cashflow from Investing activities

- Cashflow from Financing activities

- Cashflow from Operating activities

We already discussed deriving Cashflow from Investing activities & Financing activities in the last section. This section talks about deriving Cashflow from Operating activities.

3. CALCULATING CASHFLOW FROM OPERATING ACTIVITIES (INDIRECT METHOD)

All the activities of an organization that is neither financing nor investing are classified under operating activities. This section captures the cash flows related to ongoing business activities in the reported period.

Key concept to understand here is that using indirect method, we attempt to derive operating cash flows by nullifying the effect of accrual accounting basis on the net income. This is achieved by applying several adjustments to it. These adjustments are derived by analyzing changes of various current asset & current liability heads as reported on the balance sheet and studying revenues & expenses amounts as reported on income statement of the organization.

3.1 ADJUSTMENT FOR DEPRECIATION EXPENSE

The cost of fixed assets (or long-lived assets) can be expensed off over its lifetime (instead of in accounting period where were bought or paid off) using the concepts of depreciation & accrual method of accounting. This allows accountants to book depreciation expense over multiple accounting periods on income statement and thus reducing net income for each; even though in practicality there is no actual cash outflow happening for this expense head in the period.

Thus, depreciation expense must be added back to net income (because there was no actual cash outflow) to nullify the effect of accrual accounting basis.

Note. You must not confuse Accumulated depreciation account with the Depreciation expense account. Accumulated depreciation is reported on the balance sheet as a contra-asset account and Depreciation expense is reported on income statement as an operating expense account. Depreciation expense amount is subtracted from sales revenue along with other expense heads to derive net income on income statement.

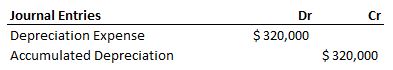

Also remember that, whenever depreciation adjustment entry is made to a fixed asset; following journal entries are created with appropriate amounts –

3.2 ADJUSTMENT FOR GAINS & LOSSES

As we discussed earlier, gains & losses from the sale or disposal of long-lived assets are to be captured under “Cash flows from investing activities”.

However, Net income (as reported on income statement) already factors in these gains & losses amounts in its derivation. Therefore to avoid double counting of these; gains on disposal of assets must be subtracted and losses must be added back to net income under cashflow from operating section.

In our example, we have a gain of $20,000 on disposal of equipment as reported on income statement; thus we need to subtract it from net income to avoid double counting. (This $20,000 gain is already reported under cash flow from investing activities).

3.3 ADJUSTMENT FOR ACCOUNTS RECEIVABLE

Revenue recognition principle & accrual method of accounting states that sales revenue for an organization is to be reported in the accounting period in which it is earned (i.e. in the period when the product or service is delivered); regardless of whether the cash is actually received or not.

The other account affected in this transaction could be either cash account or accounts receivable asset account, depending on whether the cash was received in the same accounting period or not.

The increase in accounts receivable account (on balance sheet) over the subsequent accounting periods means that sales revenue as reported on income statement was larger than the period’s actual revenue collection (cash inflows due to sales). Thus an inflated amount of sales revenue was considered for calculating net income on income statement than the actual cash inflow due to sales. In other words, the sales revenue amount used in preparing income statement overstated the cash inflows as compared to cash collection.

Therefore to counter this effect & adjust net income in-line with cash accounting basis, “increase in accounts receivable” amount must be subtracted from net income. In our example, we need to subtract $122,000 (increase in account receivable amount over period 2019-2020) from the net income to adjust it in-line with cash accounting basis or to nullify the effect of accrual accounting basis.

Note. “Accounts Receivable” account, (reported on balance sheet) is related to Sales revenue account (reported on income statement). Under accrual accounting basis, whenever a credit sales happen; following journal entries are created with appropriate amounts –

This accounts receivable asset amount would be knocked off (credited) against the Cash account (debited); in the accounting period in which the cash amounts due against this sale are received.

3.4 ADJUSTMENT FOR INVENTORIES

Under accrual accounting basis; inventory (asset) amount (on balance sheet) is expensed off via cost of goods sold (COGS) expense account (on income statement) in the period in which the sales revenue is earned.

An increase in inventory amount (on balance sheet) over the subsequent accounting periods means that more inventory was purchased in the period than was actually expensed off (or reported) via cost of goods sold account. Thus an understated COGS amount was considered for calculating net income on income statement than the actual cash outflow spent on inventory purchases.

To counter this effect & adjust these transactions in-line with cash accounting basis, “an increase in inventory” amount must be added to COGS expense account. Adding an amount to COGS expense account (on income statement) is equivalent to subtracting it from Net income account. Therefore to adjust net income to cash accounting basis, an increase in inventories amount must be subtracted from net income. In our example, we need to subtract $24,000 (increase in inventory amount over period 2019-2020) from the net income to adjust it in-line with cash accounting basis or to nullify the effect of accrual accounting basis.

Note. Inventory account (on balance sheet) and Cost of Goods sold (COGS) expense account (on income statement) are related. Under accrual accounting basis, whenever sales revenue is earned; Inventory asset amount is expensed off via cost of goods sold expense account resulting in following journal entries with appropriate amounts –

3.5 ADJUSTMENT FOR DEFERRED TAXES (LIABILITY ACCOUNT)

Matching principle states that expenses like income tax (which do not have any cause & effect linkage with sales revenues) must be reported in the accounting period in which they are incurred. The other account affected in this transaction would be either cash account or deferred tax liability account, depending on whether the income tax was paid in the same accounting period or not.

The increase in deferred tax liability account (on balance sheet) over subsequent accounting periods means that tax expense was larger than the period’s tax payments. Thus a larger amount (of tax expense) was subtracted from sales revenue on income statement to derive net income than the actual cash outflow (i.e. tax payment). In other words, the amount subtracted for income taxes in preparing income statement overstated the cash outflows as compared to actual tax payments.

Therefore to counter this effect & adjust net income in-line with cash accounting basis, “an increase in deferred tax liability account” amount must be added back to net income. In our example, we need to add $8,000 (increase in deferred tax amount over period 2019-2020) to the net income to adjust it with the cash basis or nullify the effect of accrual accounting basis.

Note. “Deferred taxes” is reported on balance sheet as a liability account. It is a credit balance account and must not be confused with the Tax expense account captured on the income statement (Tax expense is a debit balance account). Tax expense amount is subtracted from sales revenue along with other expenses to derive net income on income statement.

Also remember that, whenever tax payments are not made in the accounting period in which they are incurred; following journal entries are created with appropriate amounts –

This deferred tax liability amount would be knocked off (Debited) against the Cash account (Credited); in the accounting period in which these deferred tax amounts are paid.

3.6 ADJUSTMENT FOR PREPAID EXPENSES

Adjustments for prepaid expenses are similar to that of inventories. An increase in the balance of prepaid expenses during the period is subtracted from the period’s net income.

Alternatively, a decrease in balance of prepaid expenses is added to net income.

3.7 ADJUSTMENT FOR ACCOUNTS PAYABLE

Adjustment required for accounts payable is the mirror image of adjustments we did for accounts receivable.

An increase in the balance of accounts payable during the period is added to net income. It reflects that the period’s expense overstates the cash outflows for payments to suppliers.

In our example, we need to add $73,000 (an increase in accounts payable amount in FY 2020) to the net income to adjust it in-line with cash accounting basis or to nullify the effect of accrual accounting basis.

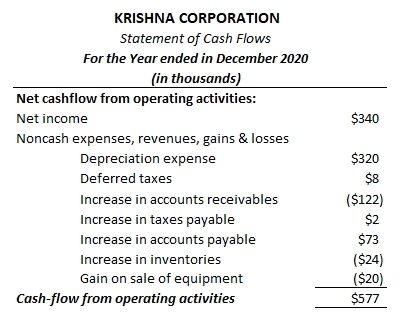

Summarizing all the adjustments explained above, cashflow from operating activities for Krishna Corporation during FY 2020 can be presented as below –

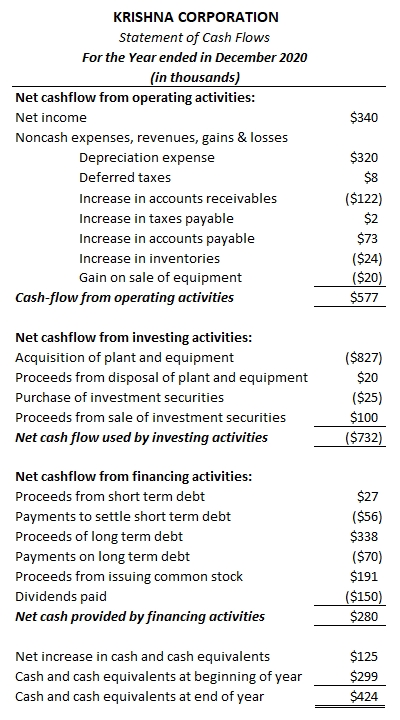

CASHFLOW STATEMENT: MERGING ALL SECTIONS

Complete cash flow statement for the FY 2020 for Krishna Corporation, basis the explanation provided can be summarized as below –