FRAMEWORK

Growth Strategies can be devised focusing on a product, division or an overall company. It is an entirely strategic decision and lays the foundation of how an organization is going to operate in coming few years. A typical growth strategy problem statement may look like one below –

Reference Case Study: Oi (formerly known as Telemar), is the largest fixed-line telephone operator and the fourth-largest mobile operator in Brazil. It is headquartered in Rio-de-Janeiro.

The year is 2020 and Oi has sold one of its major subsidiary firms to an American rival in an all-cash deal of R$700 million (Brazilian reals). Senior management at Oi is now looking forward to using the cash from this deal to accelerate the growth of the company.

A structured approach for handling case interviews as expected from a good candidate can be summarized as below –

- Summarize the Case Question

- Verify the Case Objectives

- Ask Clarifying Questions (if necessary)

- Layout the structure for solving the case as per the frameworks presented in various sections of this site.

- Final Recommendation

This article focuses on the third & fourth step as highlighted in the above approach in the context of growth strategies.

CLARIFYING QUESTIONS

Clarifying questions are quite useful in gathering additional information from the interviewer about the case and helps in identifying the most appropriate business scenario in which the case fits in. A few of the clarifying questions that can help in laying out the structure for solving the reference case study can be summarized as below –

- How is overall Telecom Industry doing in Brazil? Is it growing, de-growing or flat?

- How is Oi Telecom performing relative to the Industry?

- Are there any specific growth targets?

- Who are our main competitors? What are their market shares? Where does Oi Telecom stand in terms of market share?

- What are our strengths as compared to our competitors and vice versa?

- Is there any difference in product quality as offered by us and that of our competitors? Identify most successful product lines owned by us vs our competitors.

- How is our product priced as compared to our competitors? Are we priced competitive or at premiums? What about our competitors?

- Has the industry seen any product innovation lately by us or others? How does it go? Any learning from there?

- Any major differences in marketing done by us vs our competitors?

- Which segments of our business have highest future potential?

- Do we have funding to support the higher growth? Source of funds (debt/equity) ?

GROWTH STRATEGIES: FRAMEWORK #1

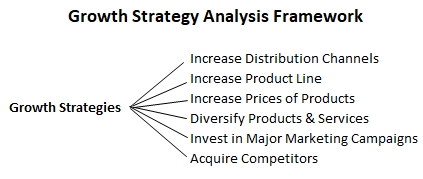

Most of the case studies in this category are designed to push candidates list down all possible growth options that an organization has and then focus on 1 or 2 options in detail for the final recommendation. Such questions in a case interview can be structured by applying the popular growth strategies given below to client’s business context –

- Increase Distribution Channels

- For Product Based Company

- Expand Current Distribution Channels

- Identify and Open New Distribution Channels (e.g. online sales)

- For Service Based Company

- Explore ways of reaching out to a bigger audience in the current Industry

- Look for a possibility of expanding your services to the other Industries

- For Product Based Company

- Increase Product Line

- Increase Prices of the Products

- Diversify Products and Services

- Invest in Major Marketing Campaign

- Acquire Competitors

GROWTH STRATEGIES: FRAMEWORK #2

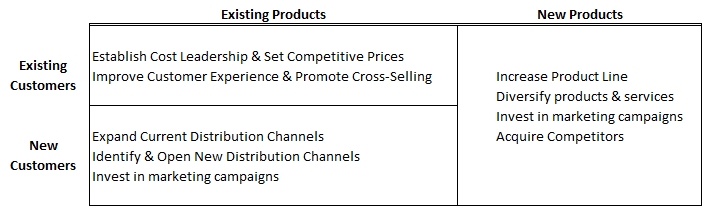

Framework #2 is nothing but a re-structured & re-phrased version of growth strategies listed above. It captures another perspective of looking into ways for growing an organization. Fundamentals of this framework can be summarized as below –

- Growth can be achieved by getting more value from the Existing customers

- Make use of cross-selling principles to sell more to existing customers

- Growth can be achieved by acquiring New customers

- Devise new products to cater needs of the untapped market segment

Details of the framework can be represented as follows –

It is important to understand that not all the growth strategies discussed above will make sense in a particular business scenario. It is upto the candidate to figure out what works best for client in the given scenario. The framework presented above is only to help him in structuring his thoughts in a more presentable way.

GROWTH STRATEGY FOR A PHARMA COMPANY

Traditional growth strategy framework discussed above cannot be applied to companies operating within pharma sector. Their growth is entirely dependent on their research and capabilities to introduce new patented drugs in the market.

When facing such a scenario in a case interview, the candidate is suggested to think on the following lines –

- Evaluate current pipeline of drugs under trail for its success rate & potential revenue

- Acquisition of competitors (who own a stronger pipeline of under trail drugs)

Example: Have a look at the below case study for reference