FRAMEWORK

Merger & Acquisition (M&A) is one of the popular growth strategies for organizations looking to expand their business offerings. A typical M&A problem statement might look like one below –

Reference Case Study: Planters is an American snack food company best known for its processed nuts. They are currently market leaders in peanut based snacks but are witnessing slow growth over years.

As part of their growth strategy, they are planning to acquire American Cashew Corp. which specializes in cashew based snacks. They have hired you to evaluate this acquisition option and make necessary recommendations.

M&As are often capital intensive investments and thus recommending an organization to go for it does require a lot of qualitative & quantitative analysis. This section discusses a step by step approach that a candidate can opt, for structuring his thoughts while solving such a case study in a business interview.

IDENTIFY THE OBJECTIVE

An organization can plan for a merger or an acquisition resulting from a variety of underlying reasons & goals. Identifying the objective at the start of the interview itself helps the candidate in framing his thoughts for a relevant analysis.

Example: Financial Analysis of the companies involved would be a more relevant study in case an organization is planning the acquisition with an objective of gaining tax benefits. Similarly, focus on Market & Competitors’ analysis would be required if the objective for the same is to Increase market share.

Thus, a good candidate is expected to clearly seek the objective of the M&A before attempting such a case question. A few of the popular objectives which can push an organization to go for a merger or an acquisition are captured as below for reference –

Possible Objectives for M&A:

- Boost Brand

- Increase Revenues / Sales (top-line)

- Increase Profitability (bottom-line)

- Gain Tax Advantage

- Increase Market Share

- Diversify Business Holdings

- Pre-empt the Competition

- Incorporate Synergies

- Cost Savings (Reduction of Fixed & Variable Costs)

- Cultural Integration

- Distribution Channel Expansion

Depending on the case objective, one of more of the following analyses would be required to evaluate the M&A option for the client –

1. Market Analysis

- How large is the other Market ?

- Calculate market size if necessary

- What is the Industry growth rate ?

- Is it growing, de-growing or flat over recent years ?

- How is the other company (one getting acquired) growing as compared to the Industry average ?

2. Competitor's Analysis

- Who are the current competitors and what are their market share?

- Is the other company a preferred brand in the market? Would they enhance or detract from each other if marketed side by side?

- How will competitors respond to this merger?

- What are the barriers to entry? Exit barriers?

3. Revenue & Cost Analysis

- Identify the revenue sources & past revenue trends for the company getting acquired?

- Identify the cost heads & past expense trends for the company getting acquired?

4. Deal Analysis

- What is the asking price/acquisition cost?

- Is the asking price more or less as compared to our valuation of the other company?

- How are we planning to finance this deal? (Debt/ Equity)

- Identify integration costs? (if any)

- Calculate Payback Period, IRR / ROI for this investment transaction

- Any other potential bidders for the deal?

5. Synergy/ Dis-synergy Analysis

- Can we leverage the existing capabilities of the other company?

- IT, Sales, Manufacturing, Marketing, Distribution, Administration based synergies?

- Bulk purchasing power from a common supplier?

- Calculate the adjusted revenue & cost figures considering the identified synergies.

- Will the acquisition cannibalize our existing sales?

- How much overlap of the customer base? (very little overlap might cause concern that brands are not compatible, too much might imply little room to expand sales by cross-marketing)

- Identify other possible investment options where the client can expect a better ROI?

6. Leadership Analysis

- How is the existing team member’s quality? Will we have to replace the management?

- How is our expertise in running the acquired business?

- Cultural fit? (E.g. A European company acquiring a US Company might face difficulties in teams management due to difference in cultures)

- Identify steps to mitigate the risk arising from cultural differences?

7. Risk Analysis

- What if the economy sours? Can we still make debt payments?

- Technology based risks?

- E.g. mobile handset technology changes significantly every two years. A heavy investment made for acquiring these kind of assets might give us returns only for short periods

- Legal risks? Regulator’s approval required?

- Any risk of losing existing customers because of acquisition?

- Are there any other bidders for the deal?

- What are their strengths and how this deal is going to benefit them?

- What if one of our competitors wins the deal? Will it be a threat to our business?

- How has been the client’s experience with mergers in the past? Does he have any exposure in integrating companies post merger?

8. Exit Strategies

- How long are they planning to hold the other company?

- Are we buying it to break it up and sell off in parts?

It is important to understand that not all the analyses discussed above will make sense in a particular business scenario. The framework presented above is only to help candidate in structuring his thoughts in a more presentable way.

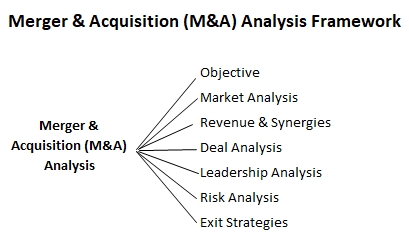

Above framework can be summarized as below –