INTRODUCTION TO FINANCIAL RATIOS (Contd ... )

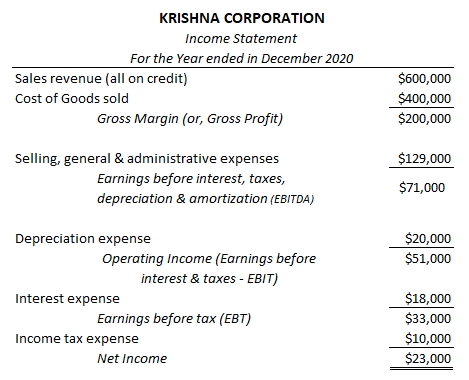

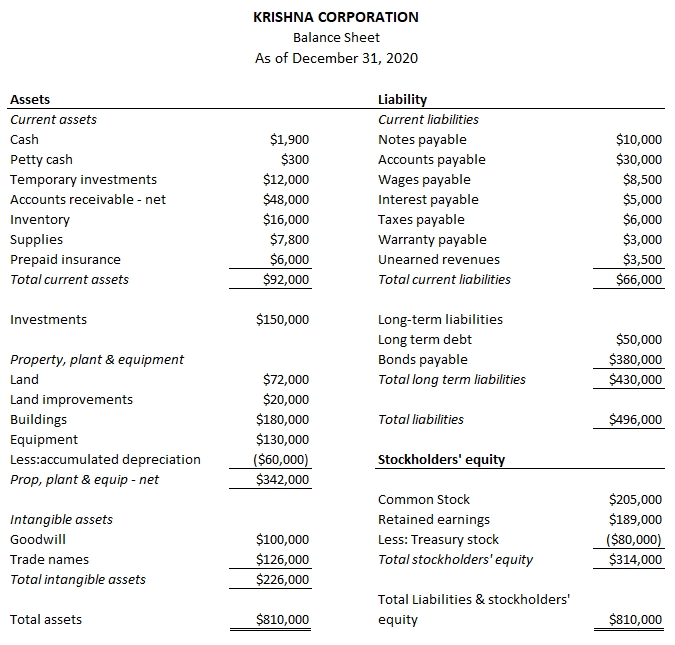

This section talks about profitability ratios and their business interpretation in detail. We will be using following income statement & balance sheet for our analysis on financial ratios and will assume a tax rate of 30% wherever applicable –

1. PROFITABILITY RATIOS

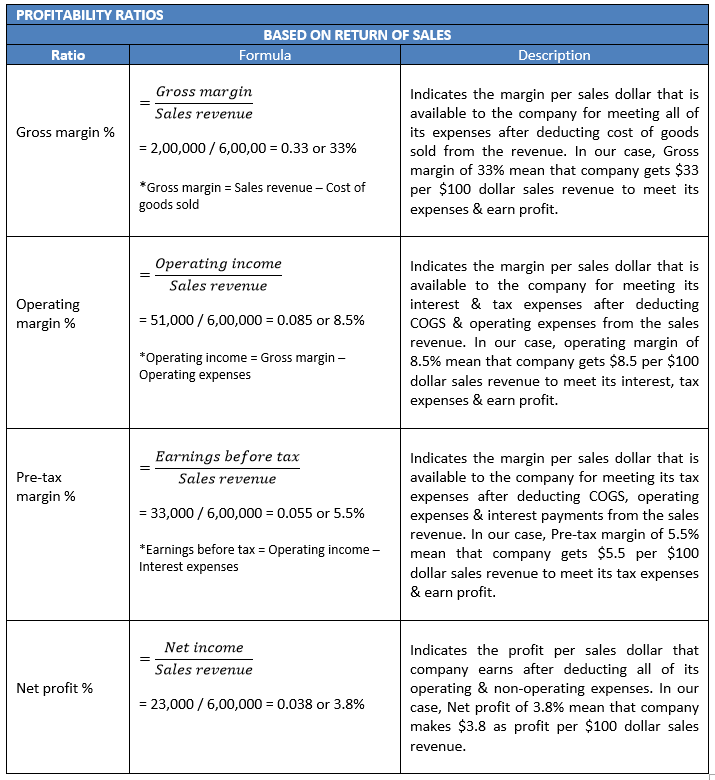

Profitability ratios indicate how good a company is in making money and generating returns for its shareholders.

Profitability ratios on a broader note can be classified into two categories. The first category discussed below talks about profitability ratios that are based on sales return –

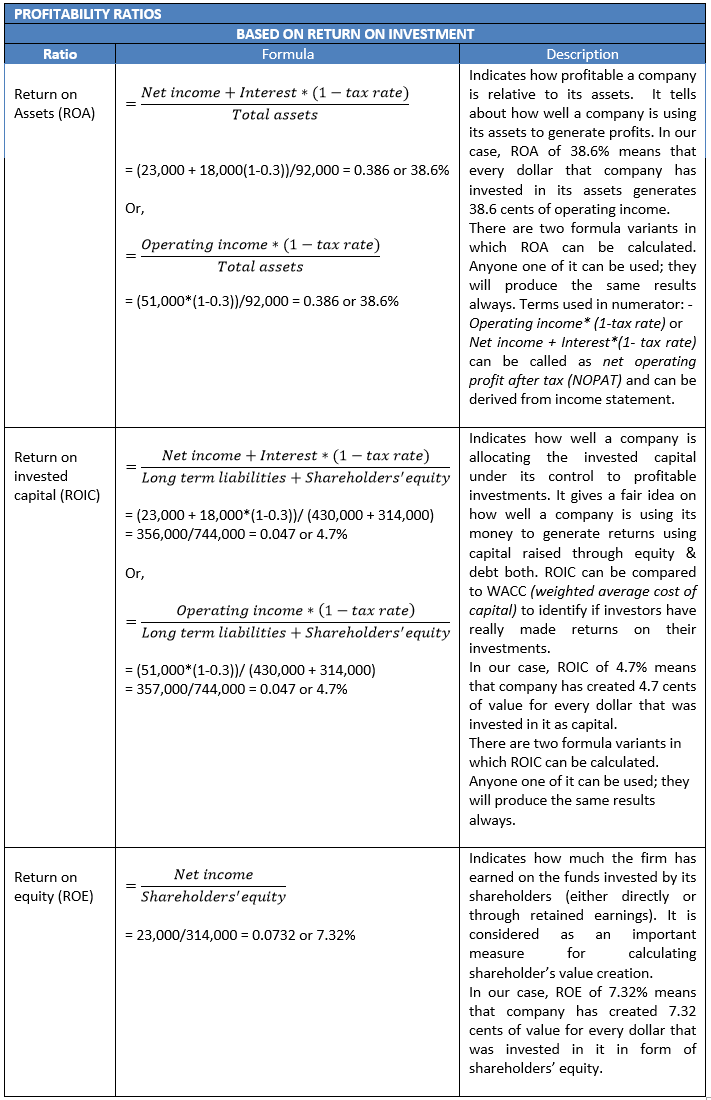

Next category of Profitability ratios discussed below talks about ratios that are based on return on investment (ROI).

Return on investment (ROI) for any business activity can be calculated by dividing Net income with Investment. The term investment can be interpreted in three different ways while conducting a financial analysis. Therefore three different ratios namely return on assets, return on invested capital & return on shareholders’ equity are often used by analysts to evaluate companies.