INCOME STATEMENT

Income statement is used to show how profitable a company has been during a particular time period. This period can vary from a week, a month, a quarter to even a year. The derivation of profitability involves two things: (1) the amount that Supreme Car rentals earned within the period by offering its services (revenue) (2) the expense that was incurred for earning that revenue. It is important for John to understand that earning revenue is not same as receipt of cash and similarly, incurring an expense is different than actually paying off cash in the period.

REVENUE

For Supreme Car Rentals, the amount earned by renting out their vehicles will be captured and reported under revenue head of the company. Under accrual accounting basis, this revenue is to be reported in the period in which it is earned, irrespective of when the actual cash is received. Reporting revenue in the period in which it is earned is in-line with revenue recognition principle of accounting.

Example. A multi-national company has struck a deal with Supreme Car Rentals for providing the car rental services to its employees. As per the agreement, all the services availed in the current month will be settled in the subsequent month.

Supreme Car Rentals start their operations in January, 2021 and provides $5,000 worth of car rental services to the MNC in the same month. As per the agreement, this amount would be settled only by the end of February 2021.

Under accrual accounting basis, Revenue is said to be earned in the period in which the service is provided or the product is delivered. Thus in our case, even though client won’t be paying Supreme Car Rentals until February, 2021, the accrual basis of accounting requires that the $5,000 be reported in January as revenue. The income statement for January will show how profitable the company was in providing car rental services to its clients.

$5,000 received by John in the month of February against the services provided in January won’t be considered and reported under revenue for February. In our case, money received in February is considered just a receipt and not revenue. This $5,000 of receipts in February is recorded as a reduction in Accounts Receivable for the company.

EXPENSE

The January’s Income Statement should show expenses incurred during the period regardless of when the company actually paid for them.

Example. John hired an employee in January to help him with the administrative work at office. He agreed to pay him $500 per month. Income Statement reported for January Period will capture this amount as January’s expense regardless of when John actually pays to its employees. What matters here is the period in which the work was done.

The period in which the work is done is the period in which the expense will be incurred and reported on the Income Statement.

Another such expense would be Interest expense. Assume John has borrowed $50,000 from banks to start Supreme Car rentals and is required to pay back a lump sum amount of $7,200 each year in December for the next 10 years. Though Interest on the borrowed capital is required to be paid only once in a year, but still a portion of it (in our case, $7,200/12 = $600) will be incurred as expense each month and reported in each month’s Income Statement.

The interest expense in this case is considered as a cost that is necessary to earn the revenue shown on income statements.

John appreciates Laura for her time and thanks her for explaining the importance of Income Statement to him in a comprehensible way. On his way back home after the session, he recalls the discussion with Laura and summarizes the key concepts in his mind –

- Income Statement tracks down profitability of the company in a particular period

- Income Statement comprises of two broader heads –

- Revenues (Income generated by the business in the period)

- Expenses (Expenses incurred by the company to generate the above revenue in the same period)

- Revenues must be reported on the Income Statement in the period in which they are earned regardless of when the company actually receives the money

- And expenses must be recorded in the period in which they are incurred regardless of when they are actually paid off

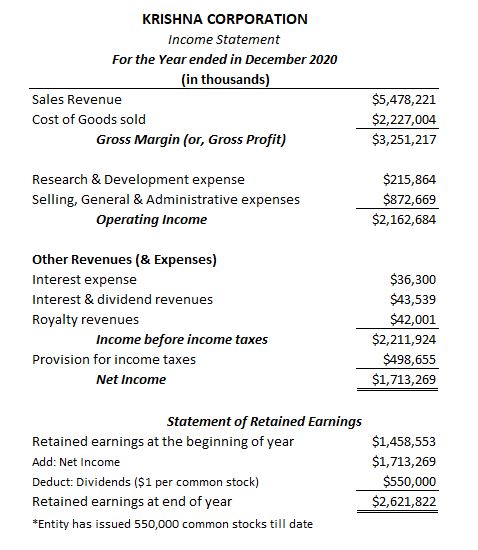

- A few of accounts captured on Income Statement are –

- Revenue accounts (Service revenue/ Sales revenue, Investment revenues etc)

- Expense accounts (Depreciation expense, Rent expense, Salary expense, Interest expense etc)

Table of Contents : Accounting Principles

Accounting Principles & guidelines