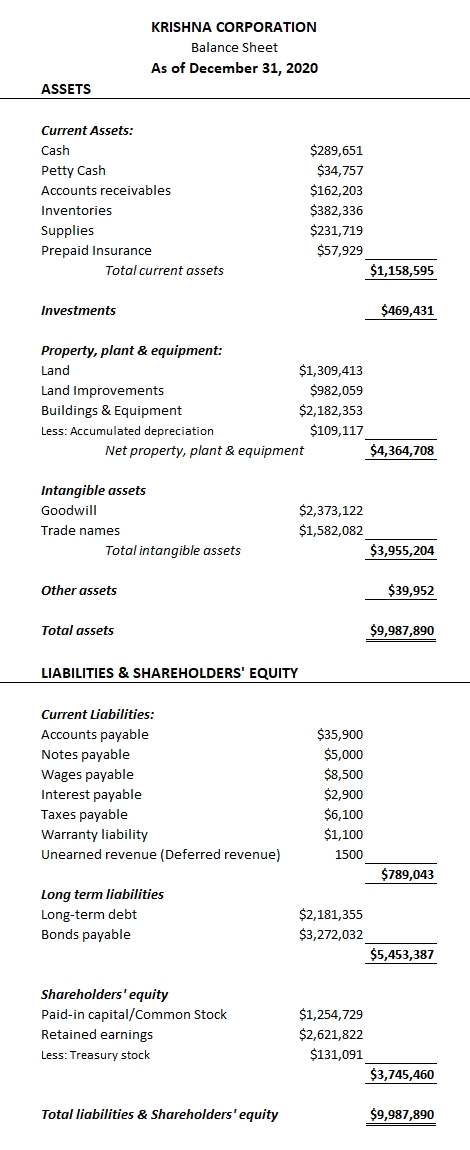

BALANCE SHEET

Balance sheet is a financial statement that captures an organization’s assets, liabilities and equity information at a specific point in time. As an example, a balance sheet dated 31st December would capture the account balances of the company’s assets, liabilities and equities after all transactions till December 31 have been recorded in the books.

ASSETS

The resources that are owned by the company and are utilized to generate revenues are termed as Assets. These are the economic resources whose fair value can be objectively measured. In our case, the vehicles owned by Supreme Car rentals will be termed as assets.

Assets section on balance sheet is further classified into following categories:

Current Assets

- Assets which are expected to liquidate within the operating cycle of the organization are categorized under this section. Examples of current assets are cash, short term investments, inventory, prepaid expenses, accounts receivable etc

Long term Investments

- This category includes assets like the long term investments in other companies, bonds, the cash surrender value of life insurance, cash restricted for construction of plant & equipment etc

Property, plant & Equipment

- Land, buildings, machinery, equipment, furniture, fixtures and vehicles used in business operations are categorized under this non-current asset category. The value of all these assets is depreciated over their useful life, except for land.

Intangible assets

- Intangible assets represent non-physical valuables of an organization. These could be goodwill, patents, copyrights, trademarks and other intangible assets that were procured by the organization at any cost. The value of these assets items are reported as their acquisition cost minus any amortization or write down due to impairment. It is important to understand here that non-physical assets that were acquired by the company against some cost are only listed under this category. Valuable trademarks and logos that were developed by a company through years of advertising are not reported because they were not purchased from another company or person

Other assets

- This category often includes costs that have been paid but are being expensed over a period greater than the operating cycle of the company. Examples include bond issue costs, deferred income taxes etc

Assets are always reported on the balance sheet at their original cost. No appreciation or inflation related adjustments are ever imposed on these values. This is done in accordance with the cost principle.

Although accountants can never increase the asset value on a balance sheet but they might decrease its value at times because of conservatism principle. Conservatism principle states that if an accountant faces a situation where he has to select from two or more amounts for reporting an asset, expense, revenues or a liability; the preference should be given to a larger number when measuring liabilities and expenses and to a smaller number when reporting assets or revenues. This principle allows accountants to anticipate and report losses early but wait for gains unless they are certain.

Example. John bought 100 gallons of gasoline in a bulk deal from a dealer at $2 per gallon in January. These 100 gallons of gasoline would be reported as $200 worth of inventory on the balance sheet dated January 31 for Supreme Car rentals. Say if by March end, oil prices crashes worldwide and gasoline prices in US drops to $1.6 per gallon; the conservatism principle instructs the company to write down its inventory value to $160 and report a loss of $40 on its Income Statement as a result of this market change.

Conservatism principle should not be applied on the inventory articles with fluctuating market prices. Rather these adjustments come into play when the value change is kind of permanent in nature (or is likely to stay over the life of the inventory).

In simple words, the cost principle of accounting prevents assets from being reported at a value more than its cost, while conservatism might require them to be reported at less than their cost.

depreciation

Reported value of all the assets listed under Property, Plant & Equipment (PPE) head of the balance sheet are to be reduced regularly over their useful life. This process of reducing asset value over a period of time is termed as depreciation. Assets with a definite useful life such as equipment, vehicles, buildings etc often wear-out over time & usage; hence depreciation concept helps in maintaining a more accurate net book value of such assets in balance sheet.

Depreciation can also be defined as the allocation of the asset cost (from balance sheet) to depreciation expense account (on income statement) over its useful life. We will elaborate more on this definition as we get to more advanced articles on this site.

It is important to note that concepts of depreciation are not applicable to land, although its falls under PPE asset category. The argument can be simply justified by stating that value of land never depreciates in a real life scenario; neither does this asset have any wear & tear costs associated with it.

Example. Assume Supreme Car rentals purchased a new vehicle in January, 2021 at $50,000 with an estimated useful life of 10 years. The accountant in this case is expected to depreciate this vehicle at a rate of $5000 ($50,000 /10) per year. Therefore, each year, the carrying amount of vehicle will be reduced by $5000 and a related depreciation expense would be booked on company’s income statement.

LIABILITIES

Liabilities are the amount owed to creditors for past transactions. These amounts can be seen as an obligation to the organization.

Liabilities section on a balance sheet is categorized into the following categories:

Current Liabilities

- The obligations that are to be paid within the current operating cycle of the company are classified under current liabilities.

- Examples of current liabilities are notes payable, accounts payable, income tax payable, accrued expenses etc

Non-current Liabilities

- These are also termed as long term liabilities. These are the obligations of the company which are due over longer period (generally over more than a year).

- Examples of such liabilities are bonds payable, long term debts etc

A few examples of liability accounts are:

- Accounts Payable (Amount owed to Supplier for items purchased on credit)

- Salaries Payable (Amount owed to employees of the organization for their services)

- Interest Payable (Interest amount owed to Financial Institutions against the loan borrowed in the past)

- Deferred Revenues (Deposits or Advances received by the company for future services are reported as liability under this head. It is also termed as unearned revenue)

- Notes Payable (represents the principal amount that is owed to financial institutions. It can be seen as short term debt taken by the company)

- Warranty Payable (represents a company’s liability to repair or replace defective products sold to customers)

- Accrued Expenses (The unpaid amounts that have been earned by the outside parties in exchange of past services or lending are termed as accrued expenses. These are the amounts for which company either has not yet received invoices from parties or invoices are not all required for payment of these services)

- Long term debt (represents the principal amount that is owed to financial institutions against the loan borrowed in the past. These amounts are due over longer periods)

- Taxes Payable (Amount owed to Government authorities)

STOCKHOLDER'S EQUITY

The third section of the balance sheet is Stockholders’ Equity or Owner’s Equity (depending on if it is a corporation or a proprietorship). This section on balance sheet majorly records the amount invested by investors & owners in the organization. Investors & owners are granted shares in the company in exchange of their invested capital.

The cumulative balance of accounts listed under this section is exactly equal to the difference between the asset and the liability amounts on the balance sheet. Stockholders’ equity balance is also called the book value of the corporation.

A few examples of Stockholders’ equity accounts are –

Common Stock / Capital Stock

- Investors are granted common stocks or capital stocks in exchange of the capital invested in the company. These shares can be treated as an evidence of their ownership in the company. Holders of common stocks share-in the distribution of profits of the company (via dividends) and are often involved in the election process of corporation’s director

Paid-in Capital in Excess of Par Value – Common Stock

- Premium paid by investors over & above the stated par value of the floated common stocks are categorized separately on balance sheet under this head

Preferred Stock

- Preferred Stock is a class of stock that comes with a preferential treatment of dividends. These stockholders are often paid dividends before common stockholders. They usually do not share corporate earnings but are liable to get a fixed amount each year as dividend.

Retained Earnings

- It is a portion of company’s profit or net income that is retained for future use instead of distributing as dividends to the shareholders

Accumulated Other Comprehensive Income

- This head reports corporation’s cumulative income that has not been reported as part of net income on the corporation’s income statement. The items included here would involve the income or loss involving from foreign currency transactions, hedges and pension liabilities.

Treasury Stock

- Stocks bought back by the issuing company (from the open market) are classified under treasury stocks

Note: In en event where a corporation were to liquidate, payments to the lenders would be made in the following order:

- Secured lenders

- Unsecured lenders

- Preferred stockholders

- And lastly the common stockholders

Asset values reported on balance sheet represents their original cost (and not their market value). Hence, balance of stockholders’ equity section must never be associated with the market value of the corporation. It would be unwise to estimate “net worth” of the corporation using Stockholders’ equity balances from the balance sheet.

John appreciates Laura for her time and thanks her for explaining the importance of Balance Sheet in yet another very interesting session. On his way back home, John recalls the discussion with Laura and summarizes the key concepts in his mind –

- Balance sheet tracks down assets, liability & stockholder’s equity of an company at a specific point in time

- Assets are the economic resources with fair values and are used to generate revenues for the company

- Assets are always reported on the balance sheet at their original cost. No appreciation or inflation related adjustments are ever imposed on these values. At times conservatism principle might require assets to be reported at less than their cost.

- Carrying value of assets (with definite useful life) is reduced over time on balance sheet using concepts of depreciation.

- The short & long term obligations of the company are recorded under liabilities section on balance sheet

- Stockholders’ equity broadly represents the capital invested by shareholders and owner into the organization

- A few of the accounts captured on balance sheet are –

- Assets accounts (Cash, Accounts Receivable, Inventory, Property Plant & Equipment etc)

- Liability accounts (Notes Payable, Accounts Payable, Salary Payable etc)

- Stockholders’ Equity (Common Stock, Retained earnings, Treasury stocks etc)

Table of Contents : Accounting Principles

Accounting Principles & guidelines