REVERSING ADJUSTMENT ENTRIES

Accrual type adjusting entries (Accrued revenues & expenses) are the additional journal entries reported in the system to capture transactions that has occurred but the company has not yet captured them into the accounts by the end of the accounting period. There entries are a must in order to get accurate financial statements at the period end.

Most of these entries are temporary in nature as in all likelihood these actual transactions (that required accrual type adjusting entry) would sooner or later get recorded in the subsequent accounting period. Thus, there is always a risk of double accounting (once through the adjusting entry and then again when it is routinely processed in the subsequent accounting period) if these entries are not tracked cautiously. This is where reversal concept for accrual type of adjusting entries comes to rescue.

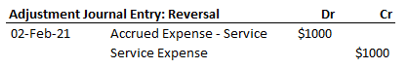

Reversal entries are dated on the first day of the subsequent accounting period immediately following the period where the accrual type adjusting entries were made. In simple words, in our examples above, if we made the adjusting entry on 31 January, 2021; a reversal for such entry would be made by 02 February, 2021.

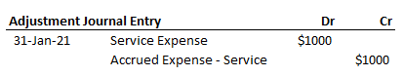

Say a company received services worth $1000 in January period but didn’t receive any supplier invoice against it. In this case, at the January period end, following adjusting entry would be required in system:

This accrual-type adjusting entry ensures that the January service expenses would be reported in period’s income statement and its liability on Period end’s balance sheet. On February 2, the following reversing entry would be recorded in system to counter the effect of accrual-type adjusting entry of December 31:

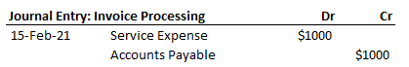

In the above example, the reversal entry removes the temporary liability and the expense created in the last period on January 31. Therefore, in the normal business scenario, whenever the company receives the invoice for the services availed, it can simply go and record the same in the system with any fear of double accounting. Important point to note here that in the month of February, the net impact on the Service expense account would be zero. Zero is the correct amount here because the expense of $1,000 belonged to January and was reported in January as a result of January 31 adjusting entry.

Table of Contents : Accounting Principles

Accounting Principles & guidelines