Case Type: Growth Strategy

Case Style: Interviewer Led

Industry: Telecommunication

Case Type: Growth Strategy

Industry: Telecom

Case by Arthur D. Little MGMT. Consulting

Oi (formerly known as Telemar), is the largest fixed line telephone operator and fourth largest mobile operator in Brazil. It is headquartered in Rio-de-Janeiro.

Year is 2020 and Oi has sold one of its major subsidiaries firm to an American rival in an all cash deal of R$700 million (Brazilian reals). Senior management at Oi is now looking forward to use the cash from this deal to accelerate the growth of the company.

Your firm has been hired to help develop growth strategies for the company. What would you recommend?

Practice with Case Partner: Format

This is an interviewer led growth strategy case where the candidate is required to suggest growth strategies for Oi Telecom within their available budgets.

Additional information (To be provided only on request)

- Oi is third largest telecom company in Brazil with an annual revenue of ~ R$20 billion (brazilian real)

- 90% Brazilian telecom market is dominated by 4 major players namely, Telefonica Brasil (35%), Claro Telecom (27%), Oi (15%) and TIM participcoes (13%)

Instructions for driving the Case Interview

Candidate is expected to solve this case by answering following questionnaires, led by the interviewer or the case partner.

Question 1: What are the possible strategies that Oi can adopt to accelerate its growth ?

Notes for Interviewer: Candidate is expected to list down the structured approach, an appropriate framework that he intends to use to explore several growth options for the client. This framework is required to test the structured thinking of the candidate and restrain him from discussing random growth options for the client.

The framework presented by the candidate is expected to involve solutions around the following heads –

- Increasing product line/ Product enhancements

- Diversify products & services

- Increase distribution channels

- Invest in major marketing campaign

- Acquire competitors

A good candidate should be able to provide a decent framework for analyzing growth options for Oi. It is an open ended question aimed at testing the industry knowledge, creativity and structured thinking of the candidate. Parameters listed under possible answer section can be referred for evaluation. An excellent candidate should be able to provide meaningful parameters beyond this list.

Network quality and customer service are the two key differentiators for any player in the telecom industry. I would suggest Oi to focus on these with the additional cash in hand. An improved service will not only increase customer retention but also pull additional subscribers to Oi’s network.

They can adopt one or more of the following strategies for accelerating their growth –

- Increasing product line & Enhancing existing products

Invest heavily in customer touchpoints. All touchpoints can be upgraded to improve client’s service discovery and product purchase experience. Be it paying bills, checking plans or subscribing to a service; all of it should be well integrated within Oi’s mobile app & website. Hassle free interaction with Oi’s support is a customer delight and an edge which Oi will have over its competitors.

- Diversify products & services

Invest in technologies of the future. Data mining, AI, 5G, virtual reality, Internet of things & Home automation etc are the technologies of the future. Client can use this excess cash to build its capabilities around the same.

For instance using data mining, Oi can better study the behavior of its customers and lead to better conversions. It can predict potential issues with specific customers and thus prevent or mitigate the impact, therefore increasing loyalty and improving retention rates for its customers.

Similarly, a next generation AI recommendation engine can boost up revenues for Oi by suggesting services to customers which are specially crafted for them basis their online behavior & traits.

Other areas where Oi can diversify are –

- Personal data security and Privacy

In the recent times, Individuals have become more dependent on technology for performing their daily routines. This habitual change has resulted in online privacy concerns for users. Oi can offer privacy management in freemium mode, with extra charges for specific security and privacy services. These can include security services like providing a control on how data is transferred to other trusted partners or to multiple third-party platform and apps.

- Partner Services

On the similar lines, Oi can provide partner services related to customer’s information & authentication to third party service providers. They can make it easier to sign up to a new service account, authenticate ATMs withdrawals or validate the identity of customers making purchases on digital platforms.

- Advertising & data services for media

Telcos like Oi have the potential to supply knowledge about consumers – such as what they watch on TV and online, their movements etc that can provide insights to media and advertisers. This type of intelligence could also be used for traditional forms of offline advertising.

- Increase distribution channels

With so much on plate to offer, Oi can upgrade a few of its retail stores to Experience stores where it can showcase all its latest technologies and offerings to its customers. This will boost user engagement with the brand and eventually their loyalty will improve.

- Invest in major marketing campaign

To spread awareness of all the latest happenings at Oi, they can host annual; bi-annual tech shows. They can alternatively invest in nation-wide marketing campaigns as well. Hiring tech influencers to talk more about the latest from Oi can really boost market and customer confidence in the offerings of the company.

- Acquire competitors

At the end, they can look out for smaller players in the market for acquisition to scale up their infrastructure or customer base at a rapid pace.

Most of the above strategies can be clubbed together under a broader umbrella for adding new customer base and retaining the existing one.

Question 2: Government of Brazil has decided to release an additional wireless band of spectrum for commercial use and has invited bids from all major telecom players for its auction. What rationale & parameters do you think Oi should consider while calculating the bid amount for this license?

Notes for Interviewer: Ideally telecom companies conduct cost benefit analysis for calculating maximum bid amount in such scenarios. A good candidate is expected to reply on similar lines.

Oi must calculate the bidding amount by considering the additional monetary gains that it is likely to have by integrating this new wireless spectrum into its existing network.

For telcos like Oi, majority of its revenue comes by providing communication services to its subscribers; which are tracked monthly using metrics called ARPU (average revenue per user). Adding this new spectrum into client’s network can boost their revenues in two ways –

- Improve our network and boost the customer retention. There are also chances that we might be able to host a few additional chargeable services on our network leveraging this additional spectrum. Thus, increasing ARPU for our existing customers.

- Also due to improved infrastructure and additional service; New subscribers might join our network. In that case, We are likely to witness additional ARPU from the new subscribers

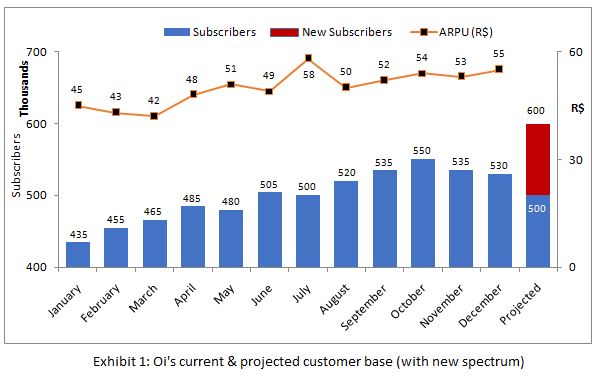

Question 3: Share the following exhibit with the candidate and ask him to calculate the maximum bid amount for the spectrum auction that client can quote.

Additional information with exhibit (To be provided on request)

- If Oi wins the spectrum auction, its ARPU is likely to increase to an average value of R$55 for its existing customers

- Oi is likely to gain 100k new subscribers at R$40 ARPU value post integrating the new spectrum into its current bandwidth

- The monthly upkeep on the new wireless network would be R$500,000

- Oi has a corporate discount rate of 12%

Notes to Interviewer: Using exhibit 1, a good candidate is expected to derive following insights –

- Average annual customer base for Oi can be calculated as 500,000

- Average ARPU over the year for Oi can be calculated to as R$50

- With the new spectrum in place, Oi is likely to add 100k new subscribers into its network

For performing detailed cost-benefit calculations, Candidate is expected to ask about revised expected ARPU values with new spectrum in place, for both existing as well as new subscribers. He will also need the running cost of this new network for his analysis. Interviewer is expected to furnish these data points using the information as provided along with the exhibits.

A good candidate is expected to calculate following data points using the information provided or using suitable assumptions –

- Annual additional gains expected from existing subscribers = R$ 30 million

- Annual gains expected from new subscribers = R$ 48 million

- NPV of net annual gains at 12% discount rate = R$ 600 million

Basis these calculations, a good candidate is expected to recommend R$ 600 million as the maximum bid amount for this spectrum. Any amount quoted above this value is likely to result in losses from this transaction.

Note: It is perfectly okay for candidate to come up with slightly different numbers for the above heads, provided his analysis & assumptions makes sense.

Data from the exhibits can be re-arranged as follows for better understanding –

Thus, the following insights can be derived from exhibit 1: –

- The average annual customer base for Oi can be pegged at ~500,000

- Average ARPU over the year for Oi can be pegged at R$50

- With the new spectrum in place, Oi is likely to add 100k new subscribers to its network

Using the additional information provided along with exhibits, the following calculations can be performed –

Thus, the client can expect R$ 600 million as the lifetime return by adding this additional spectrum into its current network. Therefore, the bid value that the client can quote for this auction must be less than equal to R$ 600 million.

Question 4: Ask the Candidate to summarize his recommendations.

A good recommendation should conclude investing a maximum of upto ~R$600 million of client’s cash reserves in purchasing the spectrum and investing the remaining amount for improving the existing products & services as offered by the client. An excellent recommendation will also include risks involved in the process along with an action plan.

Our client Oi has R$700 million in cash reserves that it is looking forward to use for accelerating the growth of the company.

Client is recommended to invest upto a maximum of ~R$600 million on purchasing the additional spectrum. Acquiring it would enable Oi to charge more from its existing customers and also attract new subscribers to its network.

The remaining capital can be used by client for improving its current product & offerings. It can be done by adopting one or more of the following strategies –

- Upgrading & Improving customer touchpoints

- Investing in future technologies like data mining, AI, 5G, virtual reality, Internet of things & home automation

- Investing in Experience stores as enhanced distribution channels

- Investment in major marketing campaigns

- Acquisition of competitors

Plan of Action

- Competitors analysis : identifying how this added spectrum can benefit competitors

- Any potential threat to Oi from competitors in case it loses the auction?

- Detailed market study & analysis of other strategy options