ACCRUED REVENUES

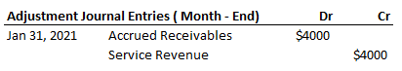

Under accrual accounting principle, a company is expected to report all the revenue that it has earned within a period irrespective of when it actually gets paid for it. Say a company has provided its service to the client worth $4000 in revenue in the month of January 2021. The company has not yet recorded this service invoice in system and is expected to do so in first week of February.

In such a scenario, in order to generate an accurate income statement, the company is expected to report following additional journal entry/ adjusting entry in system on the last day of the period (or month):

ACCRUED EXPENSES

Under the accrual method of accounting, the financial statements of a business must report all of the expenses (and related payables) that it has incurred during an accounting period and it includes the expenses that has occurred even if a supplier’s invoice has not yet been received.

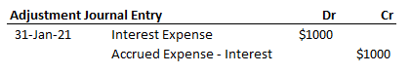

Scenario 1. Say a company borrowed money $12000 from a bank at 10% annual interest rate on January 01, 2021 with a quarterly interest payment term. The total interest to be paid against this loan will be $1200 (10% of $12,000) in a year and $3000 ($12,000/4) payment is expected at the end of each quarter.

It is important to note here that although payment of $3000 is happening at the end of each quarter against this loan, but in reality this loan is costing the company an interest expense of approximately $33.33 for each day which rolls up to $1000 per month. This additional liability owed by the company in January period must be reported by creating an adjusting entry in the system. This adjusting entry in our case will be as follows:

Some texts refer Accrued Expense as Accrued Liability. One should not get confused with this naming convention. It is just another term to represent the same thing.

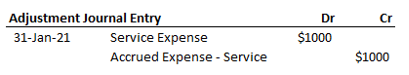

Scenario 2. A company availed third party services worth $1000 from a vendor in the month of January, 2021. The invoice for these supplier services is expected by first week of February, 2021.

Although, the company has not received any invoice in the January period, but still it owes a liability to the service provider in the period. To record this in system and enable its impact in January-end financial statements, the company will have to make an adjusting entry including the service expense and liability accounts for the month of January, 2021. This entry would be as follows:

Table of Contents : Accounting Principles

Accounting Principles & guidelines