Case Type: Growth Strategy

Case Style: Interviewer Led

Industry: Parking Services

Case Type: Growth Strategy

Industry: Parking Services

Case by Boston Consulting (BCG)

Our client, Saif solutions owns and runs a parking space in Dallas, Texas near a busy commercial region. It currently operates a parking space of 1 acres which can accommodate approximately 150 cars.

Owner of Saif Solutions, Mr. Saif has recently met with an opportunity where he has an option to buy an adjacent 0.5 acres of land to extend his capacity with another 80 spaces for car parking.

Mr. Saif has engaged us to help him in making this decision on whether he should or not grab this opportunity. What would you recommend?

- Acquiring additional land will cost $4 mn. Developing it into the parking space will add that value by another $1 mn

- Mr. Saif has sufficient cash reserves to fund this investment. (i.e. assume cost of capital to be 0)

- This is the only parking space available in the neighborhood within the radius of 10 miles

- The expected rate of return for Mr. Saif on his investment is 13%

Interview Transcript Format

Candidate

So as I understand, our client Saif Parking Solutions wants to know if expanding their current facility to accommodate another 80 parking spaces makes sense for them?

Interviewer

Thats Correct !!

Candidate

Do they have any specific growth targets/ returns in mind?

Interviewer

Yes, Mr. Saif will be investing this money from his own personal reserves and is seeking atleast a return of 13% on this investment.

I would like you to structure this problem first and tell me about the factors that you would consider & need for this analysis.

Candidate

Well it would be a cost-benefit analysis scenario. The expected additional revenue in coming years from the increased capacity; needs to be compared with the land acquisition & development cost combined to understand the profitability of the project. Needless to say, a NPV (Net Present Value) analysis will be ideal for this situation.

The factors that need to analyzed for doing so can be summarized as below –

- Understanding parking space market

- What is the current demand for parking space in the locality? How does the demand-supply equation fits in for this market?

- Are we currently losing customers due to space constraint?

- What is our current average utilization rate? Operating hours?

- How has been the utilization growth rate for the existing space for years?

- What is the average parking price per hour?

- Does acquiring additional space brings in any kind of operational synergies for the client?

- Competitors Analysis

- Are there any other parking spaces nearby? How are they priced? Any distinction in parking spaces as offered by us v/s our competitors?

- What happens if we don’t acquire the land? Does it goes to one of our competitor who might extend his capacity and challenge us in future?

- Company’s Capabilities

- What would be the source of funds? Company reserves or debt? Opportunity cost for the funds?

- Does the current leadership has enough bandwidth to manage the additional space? Or, Do we need to hire an outsider for the job?

- What is the current operating margins from the existing parking spaces?

- Investment analysis

- What is the land acquisition cost? Land development cost? Require more equipment?

- What is the additional operating cost? Require more staff?

- What is the return that Mr. Saif is expecting on his investment? Anything specific?

Interviewer

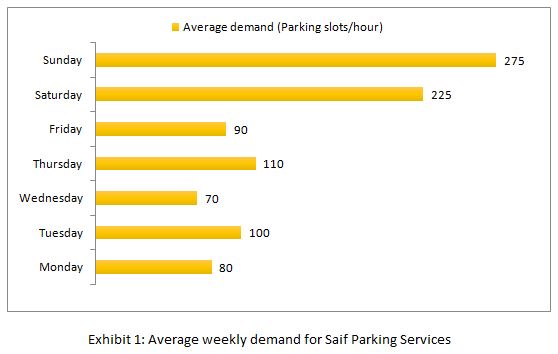

Great, that was quite a list. Now have a look at the below exhibit and analyze the market potential of the new facility.

- Car parking charges per hour at present is $2.5

- Operation timings for Saif parking services are from 10:00 am to 10:00 pm everyday

- Operating expenses for Saif parking services at present is pegged at 60%. This percentage is expected to be same for the new facility as well.

- Saif’s revenue from parking services has been growing steadily at a rate of 10% Year-on-Year

Candidate

Insights from the exhibit can be summarized as below –

- Over regular weekdays, hourly demand for car parking slots is pretty much stable and is found to be in the range of 70-110. For simplification of calculations, we can say that, average hourly demand for any weekday is 90 parking slots per hour

- Sharp spike in demand can be witnessed over weekends. This demand is in the range of 225 – 275. Again for simplification, we can assume the average hourly demand for weekends to be 250 parking slots per hour

From the problem statement, we also know that Saif’s current parking facility can host a maximum of 150 cars per hour. Therefore, on weekdays; Saif parking services is running its operations with an average utilization rate of 60% and for weekends this utilization rate goes all the way to 100% along with the unmet demand.

With unmet demand, certainly there is enough room to think about expansion, provided it makes sense quantitatively.

Interviewer

You made good enough assumptions for the above calculations.

Now can you help me in deriving the exact cashflow numbers that client can expect from this new facility?

Candidate

Yes sure, but for deriving those numbers; I would need certain inputs from you.

- What are the parking charges per hour that our client is charging at present?

- Operating hours for the facility?

- How are the operating expenses for the current facility? &

- How is the competitive presence in the region? How are they priced? Any differentiation in services?

Interviewer

All good questions. Let me answer them one by one –

- Our client is currently charging $2.5 per parking slot per hour

- They are operating from 10:00 am to 10:00 pm everyday

- Operating expenses for the last year operations at the current facility were 60%. You can assume it to be the same for the new facility as well.

- And to answer your last question; This is the only parking space available in the neighborhood within the radius of 10 miles

Candidate

Thanks for the information.

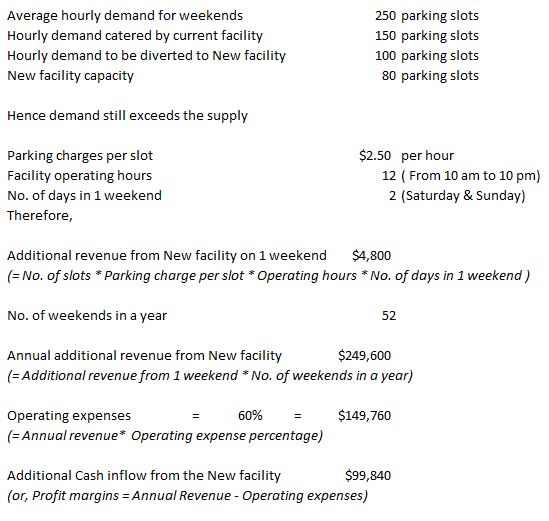

Considering the average utilization rate calculated above; we can clearly say that additional revenue from the new facility could only be generated on weekends by catering the unmet demand. Since there is no other parking facility nearby; we can safely assume that all the unmet demand is expected to be available at the new facility.

Thus client can expect ~ 100k additional annual cash inflow from the New facility

Interviewer

So, What do you say? Should we go-ahead with this investment? Is this profit margin sufficient enough to provide required returns to the client?

Candidate

We can’t say that yet. NPV analysis would be required to make that decision. But for that, I will need a few more additional inputs from you –

- What is the organic growth for the parking Industry in the region?

- What is the initial investments required for acquiring & developing the parking space?

Interviewer

Fair enough! To answer your questions –

- Saif’s revenue from parking services business has been growing steadily at a rate of 10% Year-on-Year

- Acquiring additional land would cost $4 mn and developing it further into the parking space would require $1 mn over and above it

Candidate

Thanks!

NPV (Net present value) in our case can be calculated using the following formula –

Interviewer

Now what ? (with a wicked smile)

Candidate

Well, the NPV analysis has resulted in a negative value; which implies this investment doesn’t fulfill our expectations.

At the same time, leaving additional demand unmet in the market also doesn’t make much sense. Its like leaving additional cash on plate which otherwise we could have earned & taken home. All of this simply implies, we need to think smartly to crack this particular problem.

An important conclusion that can be made from our calculations above is that the current parking charges are not good enough to generate enough cash flow to meet our expectations. So one possible recommendation to the client could be to invest in the additional facility and launch it with an increased parking charges.

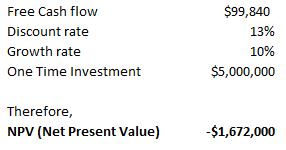

On the same lines, say we launched the New facility with an increased parking charges of $3.5 per hour; NPV in that case can be re-calculated as below –

Candidate

Net Present Value (NPV) for the cash flows resulting from this investment has turned positive now. This clearly implies that the financial goals of Mr. Saif can be met with this investment; provided he is ready to launch services in this new facility at a premium rate.

Note:- Operating expenses for the new facility in the later case will still be the same as calculated in the earlier case i.e. $149,760. Increasing per hour price won’t affect operating expenses of the client’s new facility

Interviewer

Great Job! But there is more to discuss.

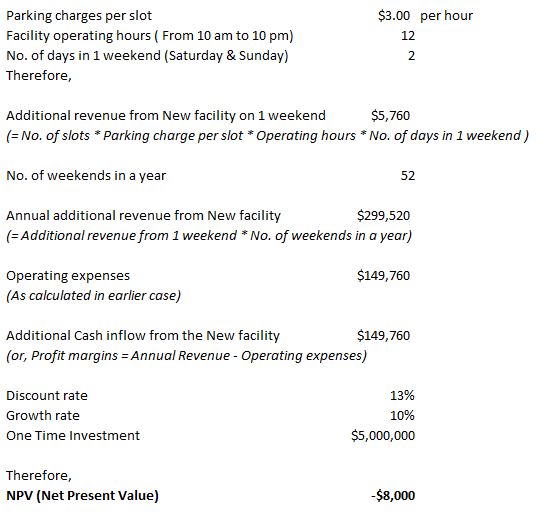

Parking facilities in the city are regulated by state authorities. At present, the local authorities have capped the maximum parking charges to $3 per hour. What would be your stand and recommendation in this case?

Candidate

Net Present Value (NPV) analysis in that case will result in below –

Candidate

Considering the regulatory requirements, the Net Present Value (NPV) has turned out to be negative again but this time its much closer to zero. (It means that Mr. Saif’s financial goals are nearly met with this investment but certainly not to the tune of 100%)

I would still recommend Mr. Saif to go-ahead with the investment and expansion plan because –

- If Saif parking solutions do not expand; there are good chances that some other competitor might invest in the space and challenge Mr. Saif’s monopoly in the region. This will certainly result in loss of revenue for Mr. Saif.

- Also, Mr. Saif can consider increasing the prices of their current facility to $3 per hour as well. This way he would be able to improve the overall profitability for his businesses and thus meet his financial goals.

Interviewer

Okay. Can you please now summarize all your case findings and prepare a recommendation for Mr. Saif?

Final Recommendation

Mr. Saif, owner of Saif Parking solutions was exploring the opportunity of whether to invest in an additional parking space as an expansion to his current facility or not.

Considering the market variables and NPV analysis, I would recommend him to go-ahead with this investment & expansion plan. However, to get the expected returns from this investment; he is advised to increase the prices for his parking services to a value of $3 per hour (from a current price of $2.5 per hour). This will ensure that he meets his financial goals along with retaining his monopoly in the business & the region.

Plan of Action (Next Steps)

- Mr. Saif should try to better negotiate this deal and bring down the acquisition & development cost of land to a value under $5mn

- Selection of contractors required for developing the land

- Marketing & Promotion Planning

Risks involved

- Competition might outrun Mr. Saif to offer a better deal for this land

- Increased prices might result in customer dis-satisfaction & trigger protest