Case Type: Growth Strategy

Case Style: Interviewer Led

Industry: Healthcare

Case Type: Growth Strategy

Industry: Healthcare

Case by ZS Associates

Our client Pfizer is a research-based bio-pharmaceutical company, developing and manufacturing human and veterinary medicines. The company’s portfolio includes human & animal biologic, small molecule medicines & vaccines, nutritional & consumer health care products. They primarily operate in US markets but are not restricted to it.

US government has recently announced a few critical regulatory changes promoting the development of drugs related to “Rare diseases”.

Rare Diseases are defined as medical conditions that affect fewer than 200,000 people in the US. Historically, pharmaceutical companies have almost ignored this field because it was not cost-effective to conduct research for diseases related to small populations. But now with govt subsidies in place to facilitate cheaper R&D; Pharma companies are looking forward to grabbing this opportunity.

Our client, Pfizer want to take advantage of this policy change as well and is targeting to double its revenue from the Rare disease business in the next 5 years. They are looking for our recommendations in devising an appropriate growth strategy.

Share the below piece of information with the candidate only on request –

- Pfizer’s current revenue from rare-disease business is $5 bn

- R&D costs for rare-disease is likely to fall as a consequence of this policy change. Knowledge of exact regulatory changes is irrelevant for this case study

- Rare-disease business has been organically growing at a rate of 5% over last few years. It would have grown at the same pace in absence of any government measures

Interview Transcript Format

Candidate

So, our client Pfizer want to double their Rare disease business in next 5 years and wants us to come up with relevant growth strategy?

Interviewer

Thats Correct !!

Candidate

I would need some inputs from you to better understand the current position of the client.

To start with, Can you help me with the current revenue that Pfizer is making from the rare-disease drugs segment? And how exactly these regulatory changes are going to benefit us?

Interviewer

Pfizer’s is making $5 bn in revenues currently from their rare-disease business.

With new regulatory changes in place; they are expected to save significant amounts on R&D costs of new drugs because of government subsidies.

Candidate

And how has been this business segment performing in the past?

Interviewer

Rare-disease business has been growing organically at a rate of 5% over last few years. And it is expected to grow at the same pace in absence of any government reform.

Candidate

So we are standing at a revenue of $5 bn in 2018 and expecting to reach $10 bn by 2022 with a natural growth rate of 5% per year

Interviewer

Yes, thats the objective. What do you think are the key drivers responsible for triggering growth in a Pharma company like Pfizer ?

Candidate

Well, possible growth sources for a pharma company could be –

- Capitalizing the pipeline of under trial drugs

- Acquisition of small competitors with potential blockbuster drugs

- Or, acquiring marketing licenses for new potential under trial drugs from competitors & leveraging their own distribution network for pushing sales

Interviewer

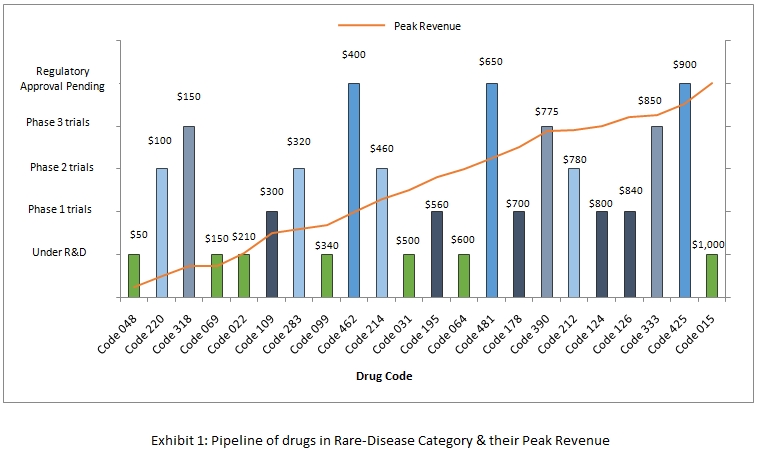

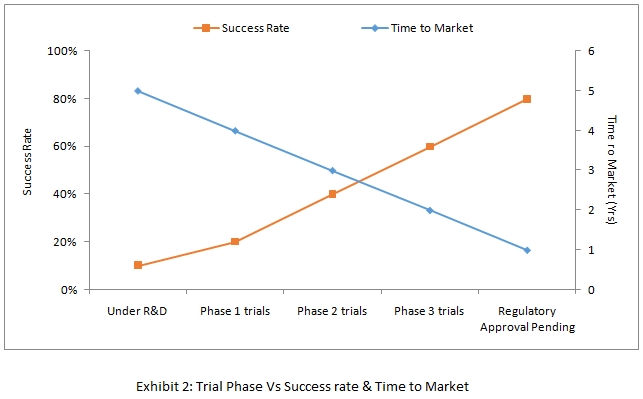

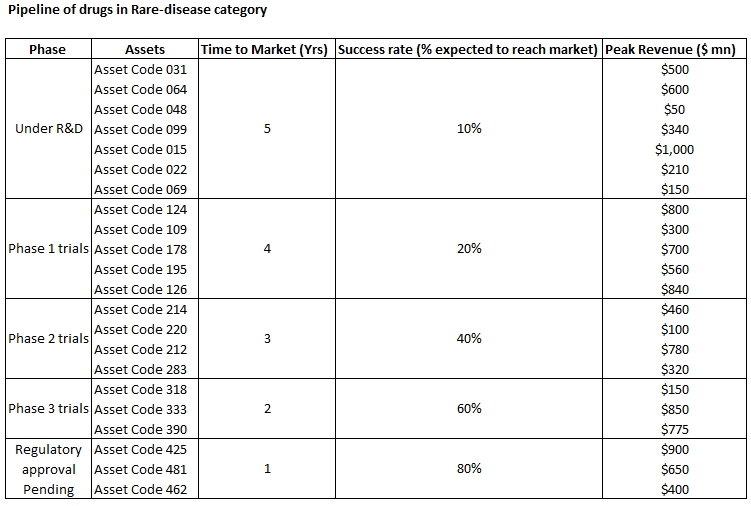

Okay, fair enough ! Have a look at the following exhibits and assess the strategic & financial position of Pfizer towards achieving its goal.

Share the below piece of information with the candidate along with exhibits mandatorily –

- Analysis of historical data suggests that it takes on average 4 years for any drug to reach to reach its peak revenue after its launch

Candidate

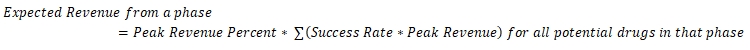

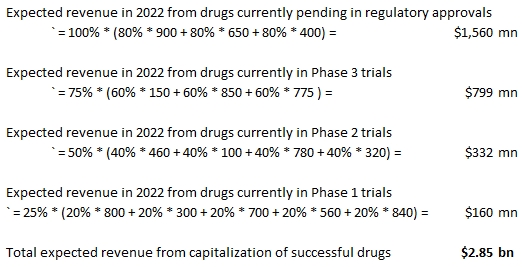

Data from the above exhibits can be re-structured as follows –

Candidate

Current year is 2018 and we are targeting $10 bn revenue by the end of operating year 2022. Majorly this would be achieved using natural organic growth from existing products and by capitalizing the under trial drugs from the pipeline. This analysis can be summarized under following two heads –

- Additional revenue expected from natural growth of 5% per-anum from the existing market offerings

For the simplification of calculations, I will ignore the compounding affect on growth and assume that we are likely to grow 5% steadily on today’s base value of $5 bn for each future year i.e. by $250 million per year

- Additional revenue expected from capitalization of successful drugs in our pipeline

Considering Time to market for different phases; we can conclude that drugs which are currently in phase 1 & above trials can only contribute in achieving our goals by 2022.

For below calculations, I am assuming here that any drug launched in the market after being successful at all evaluation phases will achieve its peak revenue in 4 years linearly (i.e. in the first year of launch; its expected revenue will be 25% of its peak value; In the second year, it will be 50% of its peak value and so on). This % of peak value is referred to as Peak Revenue Percent for the below calculations –

Thus, Pfizer can expect an additional revenue of $1.25 bn from organic growth + 2.85 bn from capitalization of drugs in pipeline; i.e. $4.10 bn in total. On adding this additional value on top of their current revenue ($5bn); we can conclude that Pfizer is most likely to reach a revenue of $9.1 bn by the end of 5 years.

Thus, there is an expected short fall of 900 mn in reaching the original goal of $10 bn revenue using the current assets.

Interviewer

What do we do now? Our CEO has already committed $10 bn revenue by end of 2022 to the board members.

Candidate

Pfizer can made up for this shortfall by adopting one or more of the following strategies –

- Acquire small competitors with collective revenue potential of around $900 mn in next 5 years

- Acquire assets whose trial are in phase 2 or above to improve their expected revenues and hence made up for this shortfall

- Lease out their existing distribution network or other resources to small non-competing medical startups in exchange of a revenue share

Interviewer

Great! Can you now please summarize all your case findings and prepare a recommendation.

Candidate

Sure, Our client Pfizer wants to double its revenue for rare disease category in next 5 years. As per our analysis, in the best case scenario they are expected to reach ~$9 bn using the organic growth & capitalization of current assets. To made up for the shortfall of another ~$1 bn; Pfizer is advised to adopt one or more of following growth strategies –

- Acquire small competitors with collective revenue potential of around $900 mn in next 5 years

- Acquire assets whose trial are in phase 2 or above to improve their expected revenues and hence made up for this shortfall

- Lease out their existing distribution network to small non-competing medical startups in exchange of a revenue share

Plan of Action (Next Steps)

- Detailed study on all the options as presented above to made up for the shortfall

Risks involved

- Our entire analysis is based on the reported success rate & peak revenue for each of our assets. The accuracy of our analysis completely depends on the under-lying assumptions made for deriving these numbers.