Case Type: Growth Strategy

Case Style: Interviewer Led

Industry: Telecommunication

Case Type: Growth Strategy

Industry: Telecom

Case by Arthur D. Little MGMT. Consulting

Oi (formerly known as Telemar), is the largest fixed line telephone operator and fourth largest mobile operator in Brazil. It is headquartered in Rio-de-Janeiro.

Year is 2020 and Oi has sold one of its major subsidiaries firm to an American rival in an all cash deal of R$700 million (Brazilian reals). Senior management at Oi is now looking forward to use the cash from this deal to accelerate the growth of the company.

Your firm has been hired to help develop growth strategies for the company. What would you recommend?

- Oi is third largest telecom company in Brazil with an annual revenue of ~ R$20 billion (brazilian real)

- 90% Brazilian telecom market is dominated by 4 major players namely, Telefonica Brasil (35%), Claro Telecom (27%), Oi (15%) and TIM participcoes (13%)

Interview Transcript Format

Candidate

So, our client Oi, a telecom player wants to figure out ways in which company reserves of R$ 700 million can be used to fast track growth of its company?

Interviewer

Thats Correct !!

Candidate

Do they have any specific growth targets in mind? How is the telecom industry overall doing in Brazil? Who are the major players & how is Oi currently positioned in the market?

Interviewer

All good questions. The growth options presented must be within their available budgets.

About the industry, Telecom sector is growing at a double digit rate in Brazil. Four major players dominate 90% of the market share. Our client, Oi is the largest telecom company in Brazil controlling around 15% of the total market share.

I would like you to start by sketching a few of the possible growth strategies options that Oi can adopt to accelerate their growth?

Candidate

Sure, Network quality and customer service are the two key differentiators for any player in the telecom industry. I would suggest Oi to focus on these with the additional cash in hand. An improved service will not only increase customer retention but also pull additional subscribers to Oi’s network.

They can adopt one or more of the following strategies for accelerating their growth –

- Increasing product line & Enhancing existing products

Invest heavily in customer touchpoints. All touchpoints can be upgraded to improve client’s service discovery and product purchase experience. Be it paying bills, checking plans or subscribing to a service; all of it should be well integrated within Oi’s mobile app & website. Hassle free interaction with Oi’s support is a customer delight and an edge which Oi will have over its competitors.

- Diversify products & services

Invest in technologies of the future. Data mining, AI, 5G, virtual reality, Internet of things & Home automation etc are the technologies of the future. Client can use this excess cash to build its capabilities around the same.

For instance using data mining, Oi can better study the behavior of its customers and lead to better conversions. It can predict potential issues with specific customers and thus prevent or mitigate the impact, therefore increasing loyalty and improving retention rates for its customers.

Similarly, a next generation AI recommendation engine can boost up revenues for Oi by suggesting services to customers which are specially crafted for them basis their online behavior & traits.

Other areas where Oi can diversify are –

- Personal data security and Privacy

In the recent times, Individuals have become more dependent on technology for performing their daily routines. This habitual change has resulted in online privacy concerns for users. Oi can offer privacy management in freemium mode, with extra charges for specific security and privacy services. These can include security services like providing a control on how data is transferred to other trusted partners or to multiple third-party platform and apps.

- Partner Services

On the similar lines, Oi can provide partner services related to customer’s information & authentication to third party service providers. They can make it easier to sign up to a new service account, authenticate ATMs withdrawals or validate the identity of customers making purchases on digital platforms.

- Advertising & data services for media

Telcos like Oi have the potential to supply knowledge about consumers – such as what they watch on TV and online, their movements etc that can provide insights to media and advertisers. This type of intelligence could also be used for traditional forms of offline advertising.

- Increase distribution channels

With so much on plate to offer, Oi can upgrade a few of its retail stores to Experience stores where it can showcase all its latest technologies and offerings to its customers. This will boost user engagement with the brand and eventually their loyalty will improve.

- Invest in major marketing campaign

To spread awareness of all the latest happenings at Oi, they can host annual; bi-annual tech shows. They can alternatively invest in nation-wide marketing campaigns as well. Hiring tech influencers to talk more about the latest from Oi can really boost market and customer confidence in the offerings of the company.

- Acquire competitors

At the end, they can look out for smaller players in the market for acquisition to scale up their infrastructure or customer base at a rapid pace.

Most of the above strategies can be clubbed together under a broader umbrella for adding new customer base and retaining the existing one.

Interviewer

That was quite an exhaustive list of options. Well done! Here is an short update for you ….

Government of Brazil has decided to release an additional wireless band of spectrum for commercial use and has invited bids from all major telecom players for its auction. What rationale & parameters do you think Oi should consider while calculating the bid amount for this license?

Candidate

Oi must calculate the bidding amount by considering the additional monetary gains that it is likely to have by integrating this new wireless spectrum into its existing network.

For telcos like Oi, majority of its revenue comes by providing communication services to its subscribers; which are tracked monthly using metrics called ARPU (average revenue per user). Adding this new spectrum into client’s network can boost their revenues in two ways –

- Improve their network and boost the customer retention. There are also chances that we might be able to host a few additional chargeable services on our network leveraging this additional spectrum. Thus, increasing ARPU for our existing customers.

- Also due to improved infrastructure and additional service; New subscribers might join our network. In that case, We are likely to witness additional ARPU from the new subscribers

Interviewer

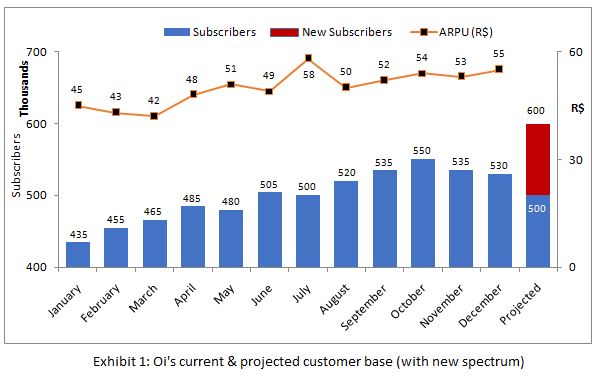

Fair enough! Have a look at the below exhibit and calculate the bid amount range that Oi can consider for quoting in this auction ?

- If Oi wins the spectrum auction, its ARPU is likely to increase to an average value of R$55 for its existing customers

- Oi is likely to gain 100k new subscribers at R$40 ARPU value post integrating the new spectrum into its current bandwidth

- The monthly upkeep on the new wireless network would be R$500,000

- Oi has a corporate discount rate of 12%

Candidate

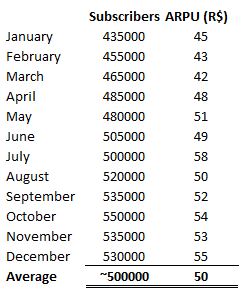

Data from the exhibits can be re-arranged as follows for better understanding –

Thus, following insights can be drawn from the above exhibit –

- Average annual customer base for Oi can be calculated as 500,000

- Average ARPU over the year for Oi can be calculated to as R$50

- With the new spectrum in place, Oi is likely to add 100k new subscribers into its network

Interviewer

Good enough! What about the bid amount range?

Candidate

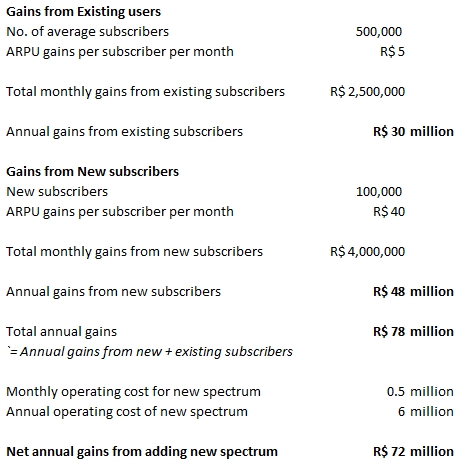

To determine the bid amount range, we need to calculate the additional revenue that Oi can expect from the existing and the new subscribers post integrating this new spectrum. To do so, we need the following –

- Existing subscriber base (given)

- Expected additional revenue from existing subscriber base (unknown)

- Newly added subscribers (given)

- Expected revenue from newly added subscribers (unknown)

- Running cost of utilizing new spectrum bandwidth (unknown)

Do we have any knowledge about the highlighted unknown variables?

Interviewer

Yeah we do, In case Oi wins the spectrum auction, its ARPU is likely to increase to an value of R$55 for its existing customers. For the new subscribers, Oi is planning to introduce discounted plans starting R$40 as monthly rentals.

And the monthly upkeep on this new wireless network would be R$500,000

Candidate

Cool, following analysis can be carried out then –

Candidate

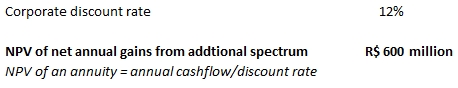

Do we have a discount rate ?

Interviewer

Assume it to be 12%

Candidate

Sure,

Thus, the client can expect R$ 600 million as the lifetime return by adding this additional spectrum into its current network. Therefore, the bid value that the client can quote for this auction must be less than equal to R$ 600 million.

Interviewer

Great! Can you now please summarize your case findings for CEOs brief?

Candidate

Our client Oi has R$700 million in cash reserves that it is looking forward to use for accelerating the growth of the company.

Client is recommended to invest upto a maximum of ~R$600 million on purchasing the additional spectrum. Acquiring it would enable Oi to charge more from its existing customers and also attract new subscribers to its network.

The remaining capital can be used by client for improving its current product & offerings. It can be done by adopting one or more of the following strategies –

- Upgrading & Improving customer touchpoints

- Investing in future technologies like data mining, AI, 5G, virtual reality, Internet of things & home automation

- Investing in Experience stores as enhanced distribution channels

- Investment in major marketing campaigns

- Acquisition of competitors

Plan of Action

- Competitors analysis : identifying how this added spectrum can benefit competitors

- Any potential threat to Oi from competitors in case it loses the auction?

- Detailed market study & analysis of other strategy options