Case Type: Growth Strategy

Case Style: Interviewer Led

Industry: Healthcare

Case Type: Growth Strategy

Industry: Healthcare

Case by ZS Associates

Our client Pfizer is a research-based bio-pharmaceutical company, developing and manufacturing human and veterinary medicines. The company’s portfolio includes human & animal biologic, small molecule medicines & vaccines, nutritional & consumer health care products. They primarily operate in US markets but are not restricted to it.

US government has recently announced a few critical regulatory changes promoting the development of drugs related to “Rare diseases”.

Rare Diseases are defined as medical conditions that affect fewer than 200,000 people in the US. Historically, pharmaceutical companies have almost ignored this field because it was not cost-effective to conduct research for diseases related to small populations. But now with govt subsidies in place to facilitate cheaper R&D; Pharma companies are looking forward to grabbing this opportunity.

Our client, Pfizer want to take advantage of this policy change as well and is targeting to double its revenue from the Rare disease business in the next 5 years. They are looking for our recommendations in devising an appropriate growth strategy.

Additional information (To Be Provided Only on Request)

Share the below piece of information with the candidate only on request –

- Pfizer’s current revenue from rare-disease business is $5 bn

- R&D costs for rare-disease is likely to fall as a consequence of this policy change. Knowledge of exact regulatory changes is irrelevant for this case study

- Rare-disease business has been organically growing at a rate of 5% over last few years. It would have grown at the same pace in absence of any government measures

Practice with Case Partner: Format

This case study provides a glimpse of how a pharmaceutical company operates and identifies factors responsible for its growth. For solving this case, the candidate must understand that a typical growth strategy framework cannot be applied in a pharmaceutical context.

Instructions for driving the Case Interview

Candidate is expected to solve this case by answering following questionnaires, led by the interviewer or case partner.

Question 1: What do you think are the key drivers responsible for triggering growth in a pharma industry context ?

Notes for Interviewer: Candidate is expected to inquire about the current financial position of the client & the present rate at which this segment is growing organically. He is expected to list down the structured approach, an appropriate framework that he intends to use to explore several growth options for the client. This framework is required to test the structured thinking of the candidate and restrain him from discussing random growth options for the client.

The framework presented by the candidate is expected to involve the following heads –

- Capitalizing the pipeline of under trial drugs

- Acquisition of small competitors with potential blockbuster drugs

- Or, acquiring marketing licenses for new potential under trial drugs from competitors & leveraging their own distribution network for pushing sales

Factors discussed above are expected to be highlighted by a good candidate without much support. The list provided here is a must but not exhaustive. Brownie points for candidates who are able to add other meaningful heads to the list.

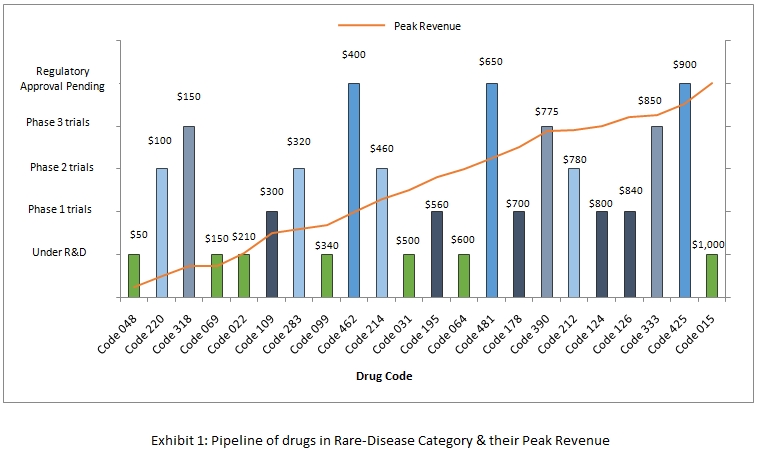

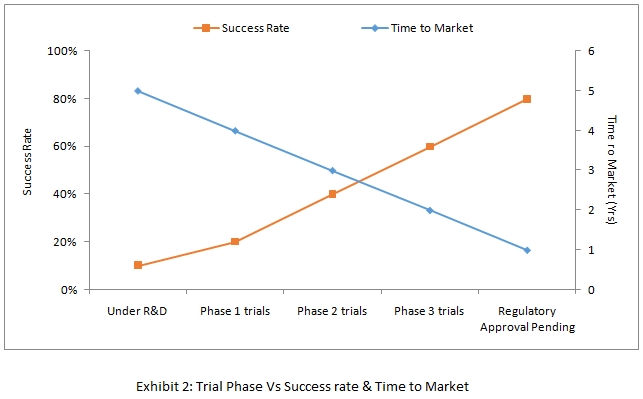

Question 2: Share the following exhibits with the Candidate and ask him to assess the current strategic & financial position of Pfizer towards achieving its goals.

Additional information (To be shared mandatorily)

Share the below piece of information with the candidate along with exhibits mandatorily –

- Analysis of historical data suggests that it takes on average 4 years for any drug to reach to reach its peak revenue after its launch

Notes for Interviewer: From the above exhibits and information provided so far, a good candidate should generate following insights –

- Pfizer’s existing pipeline of research drugs are expected to generate an additional revenue of $2.85 bn by the end of 5 years

- Also they are expected to generate another $1.25 bn via organic growth from their current market offerings

A good candidate should therefore conclude that Pfizer won’t be able to reach its targeted goal using just the current assets.

Data from the above exhibits can be re-structured as below for simplification –

Current year is 2018 and we are targeting $10 bn revenue by the end of operating year 2022. Majorly this would be achieved using natural organic growth from existing products and by capitalizing the under trial drugs from the pipeline. This analysis can be summarized under following two heads –

- Additional revenue expected from natural growth of 5% per-anum from the existing market offerings

For the simplification of calculations, I will ignore the compounding affect on growth and assume that we are likely to grow 5% steadily on today’s base value of $5 bn for each future year i.e. by $250 million per year

- Additional revenue expected from capitalization of successful drugs in our pipeline

Considering Time to market for different phases; we can conclude that drugs which are currently in phase 1 & above trials can only contribute in achieving our goals by 2022.

For below calculations, I am assuming here that any drug launched in the market after being successful at all evaluation phases will achieve its peak revenue in 4 years linearly (i.e. in the first year of launch; its expected revenue will be 25% of its peak value; In the second year, it will be 50% of its peak value and so on). This % of peak value is referred to as Peak Revenue Percent for the below calculations –

Thus, Pfizer can expect an additional revenue of $1.25 bn from organic growth + 2.85 bn from capitalization of drugs in pipeline; i.e. $4.10 bn in total. On adding this additional value on top of their current revenue ($5bn); we can conclude that Pfizer is most likely to reach a revenue of $9.1 bn by the end of 5 years.

Thus, there is an expected short fall of 900 mn in reaching the original goal of $10 bn revenue using the current assets.

Notes for Interviewer: A candidate might come up with numbers which are different than what we have presented in our analysis. It is not important to match these numbers exactly. However, the analysis & assumptions as presented by the candidate must be appropriate and relevant for the pharma industry.

Question 3: Once the candidate realizes that Pfizer can't achieve its goal using current assets; Ask him to highlight ways in which this shortfall can be made up ?

Notes for Interviewer: A good candidate is expected to highlight following ways to overcome this shortfall –

- Acquire small competitors with collective revenue potential of around $900 mn in next 5 years

- Acquire assets whose trial are in phase 2 or above to improve their expected revenues and hence made up for this shortfall

- Lease out their existing distribution network to small non-competing medical startups in exchange of a revenue share

Above list is a must but not exhaustive. Brownie points for candidate who can suggest other relevant ways to overcome this shortfall.

Question 4: Ask the candidate to summarize his recommendations for CEOs brief

A good candidate should be able to sketch out an appropriate framework for structuring this case study. Basis analysis, he should realize that using current assets, Pfizer won’t be able to achieve its goal. In the end, he should highlight relevant ways in which this shortfall can be made up.

An excellent recommendation will also include risks involved in the process along with an action plan.

Our client Pfizer wants to double its revenue for rare disease category in next 5 years. As per our analysis, in the best case scenario they are expected to reach ~$9 bn using the organic growth & capitalization of current assets. To made up for the shortfall of another ~$1 bn; Pfizer is advised to adopt one or more of following growth strategies –

- Acquire small competitors with collective revenue potential of around $900 mn in next 5 years

- Acquire assets whose trial are in phase 2 or above to improve their expected revenues and hence made up for this shortfall

- Lease out their existing distribution network to small non-competing medical startups in exchange of a revenue share

Plan of Action (Next Steps)

- Detailed study on all the options as presented above to made up for the shortfall

Risks involved

- Our entire analysis is based on the reported success rate & peak revenue for each of our assets. The accuracy of our analysis completely depends on the under-lying assumptions made for deriving these numbers.