Case Type: Merger & Acquisition

Case Style: Interviewer Led

Industry: Renewable Energy

Case Type: Merger & Acquisition

Industry: Renewable Energy

Case by Bain & Company

The global solar energy market was valued at $52.5 bn in 2018 and is projected to reach $223.3 bn by 2026, growing at a CAGR of 20.5% from 2019 to 2026.

Solar energy is the radiant energy emitted from the sun, which is harnessed by using various technologies such as solar heating, photovoltaic cells etc. Solar energy contributes to 20% of the overall energy requirements from non-conventional energy resources across the world.

Our client Beamer Inc., a US energy conglomerate is considering the acquisition of Suniva, a solar panel manufacturer with manufacturing facilities in Veitnam & India and is looking for your recommendations on the same.

This is an interviewer led strategy case where the candidate is required to help Beamer decide, whether the acquisition of Vietnam based solar panel manufacturer Suniva will make sense for them. Needless to say, the final recommendation must include facts derived using appropriate quantitative analysis.

To read the full article

THE CASE CONSULTANTS

CONTINUE READING YOUR ARTICLE WITH PRO-MEMBERSHIP

STARTING LESS THAN ₹99 PER MONTH

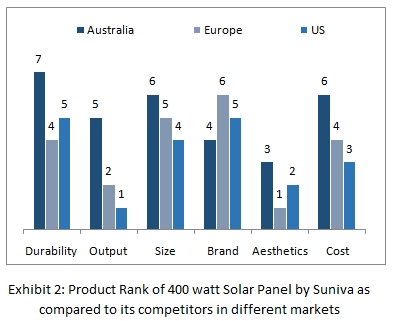

Notes for Interviewer: Final recommendation would depend on the assumptions taken by the candidate. In our case, basis the assumptions and the limited information available, we found out that it does makes sense for Beamer Inc. to go ahead with the acquisition plan of Suniva. The expected payback period for this investment is likely to be 8 years and client can use Suniva’s manufacturing capability to crack one of the most promising solar panel markets in the world i.e. the US.

An excellent recommendation will also include risks involved in the acquisition along with an action plan (next steps).