Case Type: Competitive Strategy

Case Style: Interviewer Led

Industry: Mining

Case Type: Competitive Strategy

Industry: Mining

Case by Bain & Company

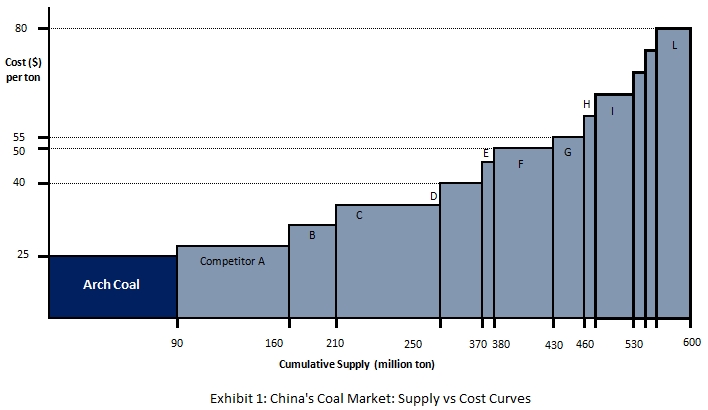

Our client, Arch Coal Ltd. is an American coal mining and processing company. The company mines, processes and markets bituminous and sub-bituminous coal with low sulfur. It is one of the largest private sector coal mining player in the US. They own coal mines all across the world and sells exclusively to the Chinese energy companies. The company is the largest supplier of coal by volume in Chinese market with 90 million tons of coal sold last year. They are also the lowest cost producer of coal in the market at $25 per ton.

In the first quarter of this year, our client has gained an additional rights to mine one of the neighboring fields (called Site B) in Haerwusu, China and wishes to increase their annual production volume to 140 million tons per year (i.e. 50 million tons of additional coal). They have hired us to conduct a study and recommend if it is worth mining this additional site now?

Additional information (To be provided only on request)

- Client’s objective behind increasing coal supply is to improve profitability & pave path for future growth of the company

- Average demand for coal in China is flat for years now and is estimated to be around 450 million tons per year.

- Initial investment required to start mining activities at Site B is $3 bn

- Projects with payback period within 5 years are preferred by Arch’s senior management

To read the full article

THE CASE CONSULTANTS

CONTINUE READING YOUR ARTICLE WITH PRO-MEMBERSHIP

STARTING LESS THAN ₹99 PER MONTH

This is an interviewer led strategy case where the candidate is required to study the economics of the Chinese coal mining industry and evaluate if it has potential to absorb 50 million tons of additional coal supply.